Real Estate Professional's

Business Development Associate Program

Value Add Agent—now with a concierge lender team and a compliant income stream.

Business Development Associate Program

[Download PDF - Get more details regarding your specific industry]

✅ Pain: Referral risk, RESPA fear, inconsistent lender follow-through.

✅ What you do: Warm introductions, file-contact add at start, status touches.

✅ How you earn: BDA structure: hours + performance % framework. No acting as agent while PT LO in most states (dual-state exception with disclosure).

Schedule Your Discovery Call Below

“You Already Have the Relationships — Now Get Paid for Them, Compliantly.”

Leverage your influence. Protect your license. Multiply your income.

Approved In As Little As

15 Minutes

IT’S EASY WHEN YOUR CLIENTS HAVE AN INITIAL APPROVAL

Want to feel good about your clients making a strong offer on their dream home?

Get an initial approval for their loan almost instantly

when they work with independent mortgage professionals like us. Our cutting-edge process lets us do what big banks and retail lenders can’t and give them an initial loan approval in as little as 15 minutes — even on the weekends!

It’s especially ideal for your buyers who are self-employed or may have contingencies pop up, clearing the way for a smooth, easy underwriting process.

Save Your Clients Thousands

HAVING A MORTGAGE BROKER IN YOUR CORNER IS GOOD FOR EVERYBODY!

Here’s a fact: a recent study shows when a borrower chooses an independent mortgage broker over a retail lender they can save between $9,407-$10,424* over the life of their loan. Now that’s some news you should share! Partner with us and help put more money in your clients’ pockets.

Go Doc-Less

GIVE YOUR CLIENTS A FASTER, EASIER MORTGAGE OR REFINANCE WITHOUT THE HASSLE OF GATHERING FINANCIAL DOCUMENTS

Here’s how it works:

✅ Your client simply e-signs the loan documents.

✅ We verify their income, assets and tax returns.

✅ We notify you and your client when the loan is approved.

Remove Your Client's Limitations

USE AN INDEPENDENT MORTGAGE BROKER.

WE HAVE ACCESS TO MORE.

You and your clients will be wowed by all the services that we as brokers offer that banks and online lenders don’t:

✅ Do just one loan application and one credit pull

✅ Shop the top wholesale lenders in the nation with exclusive programs

✅ Offer wholesale interest rates — some of the lowest in the industry

✅ Fast closings — usually in an average of 20 days

✅ Get instant funding at the closing table

✅ Have a higher approval percentage for homebuyers than banks

✅ Total transparency, with technology that lets them track their loan from start to finish

✅ The ability to lock in their interest rate while they shop for their dream home

✅ A mortgage application link they can complete on their own time and screen share with us in real-time if they need help

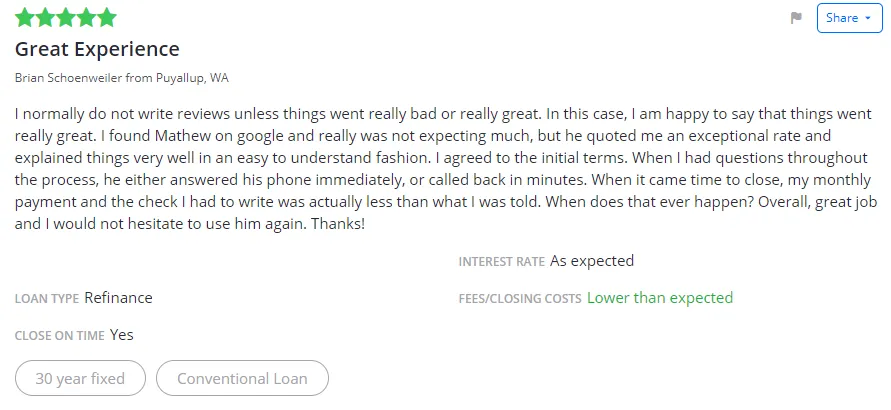

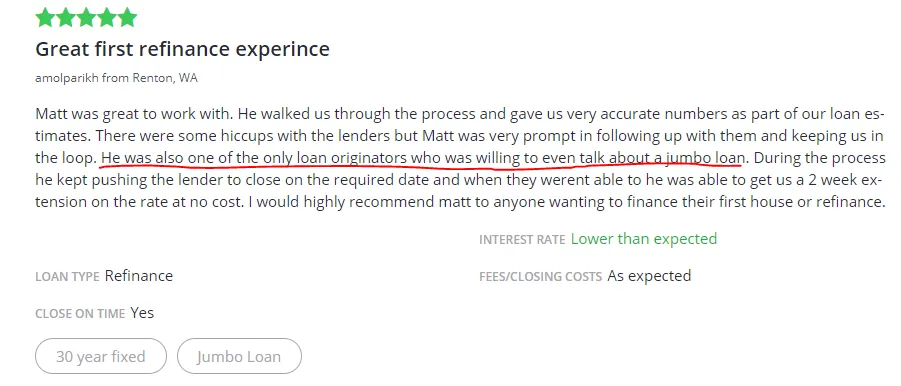

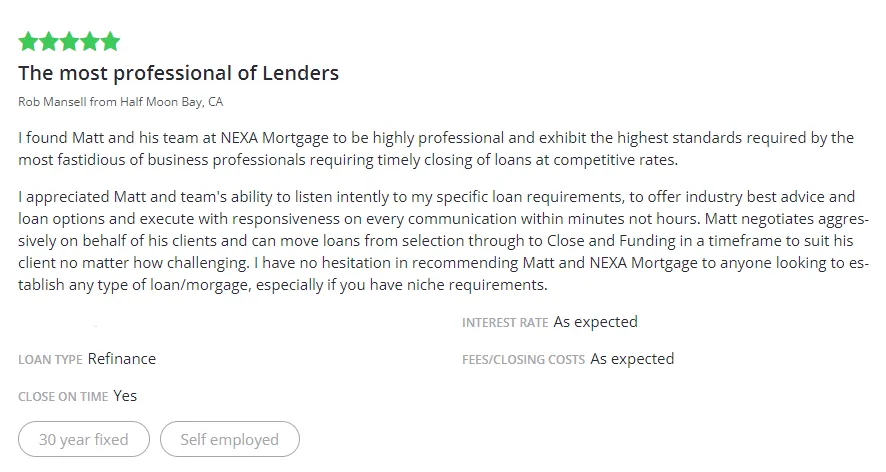

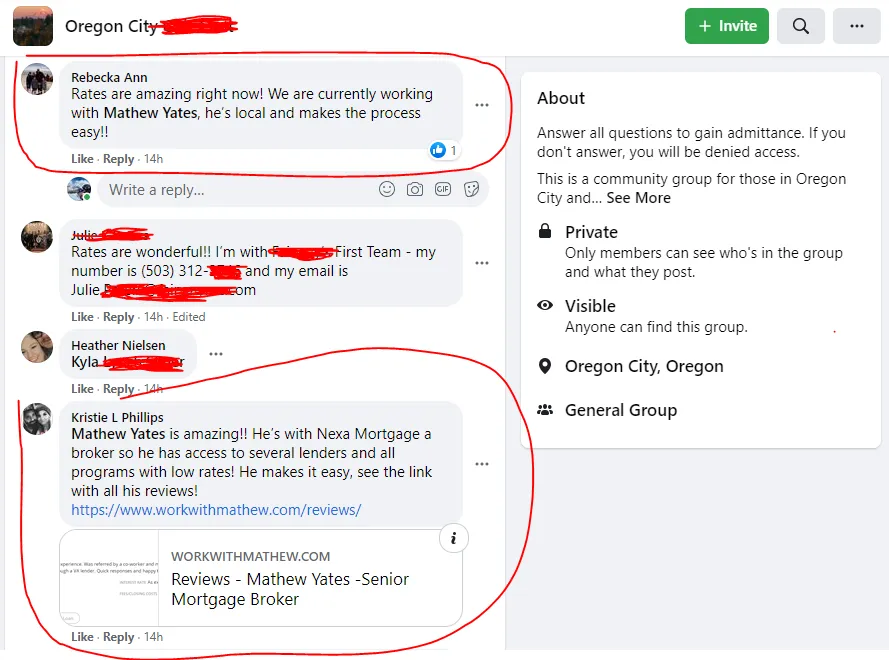

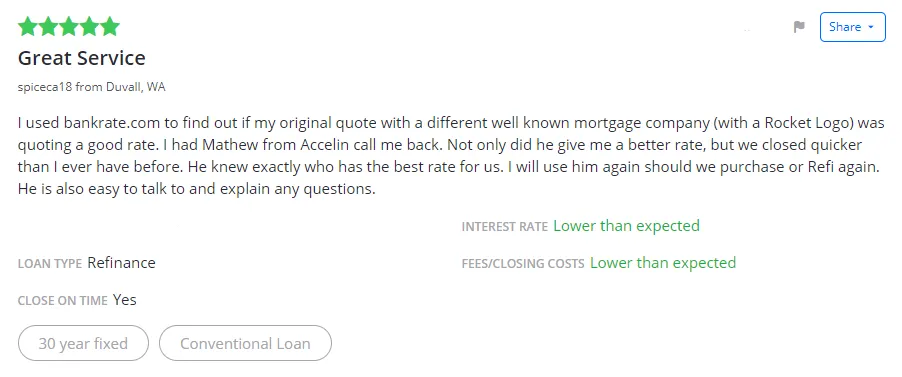

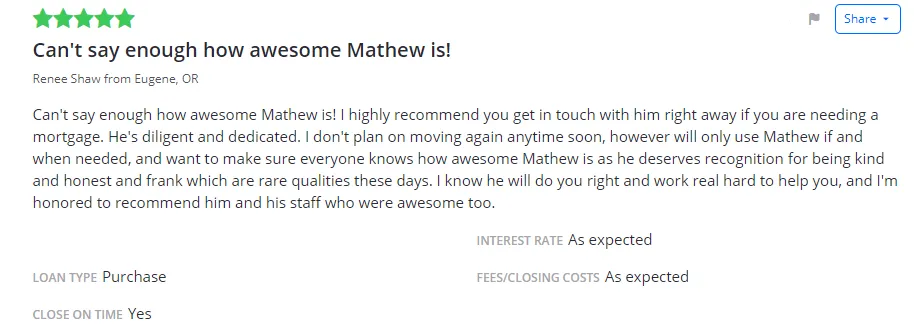

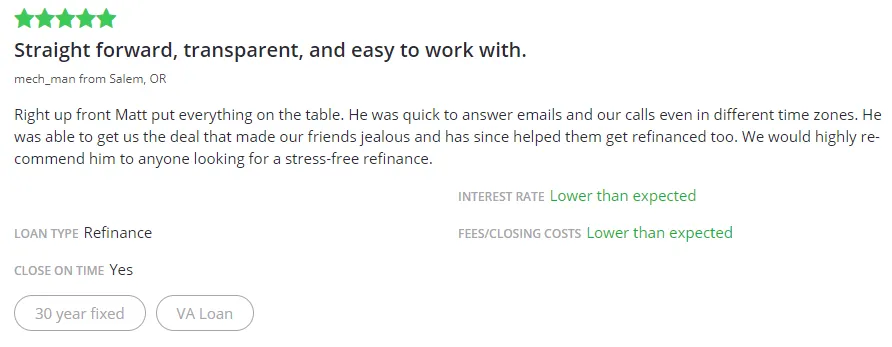

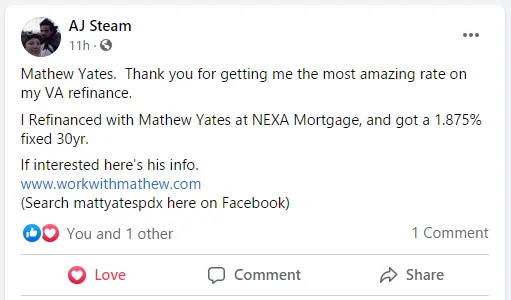

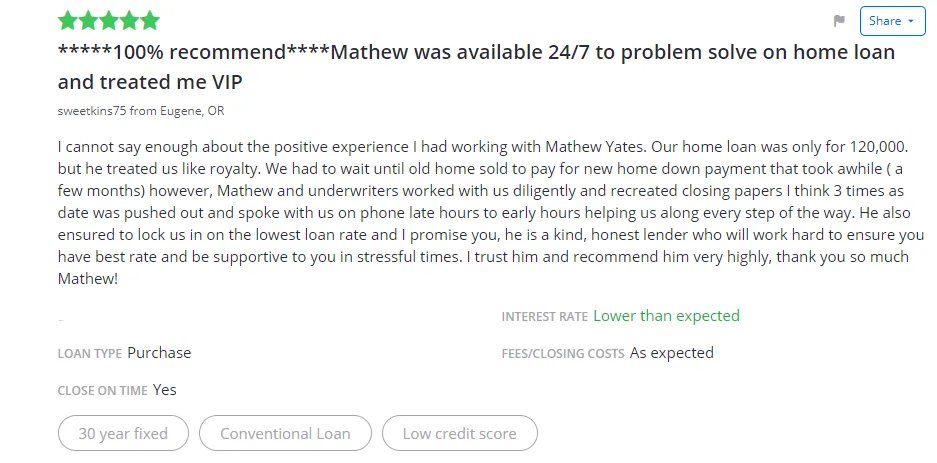

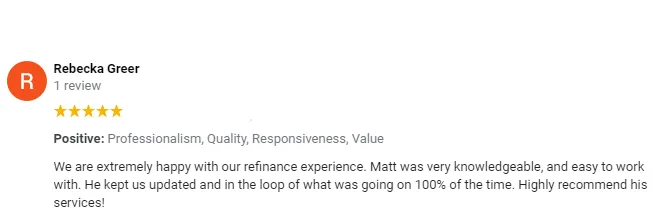

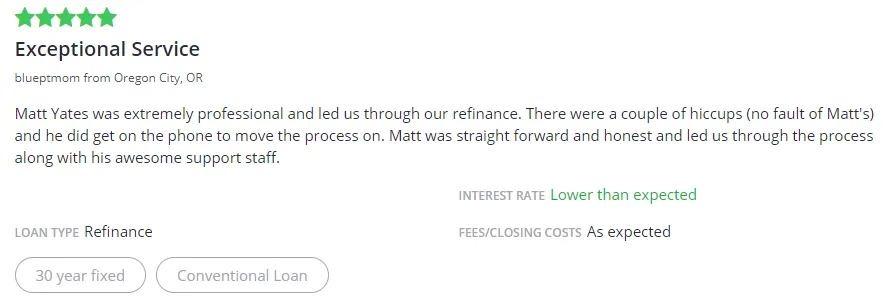

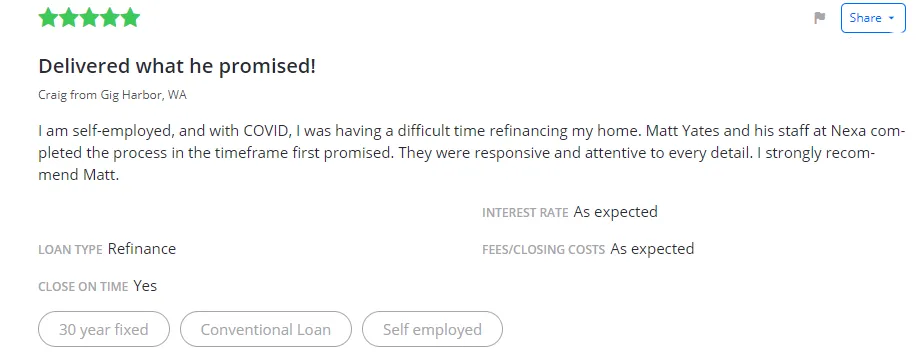

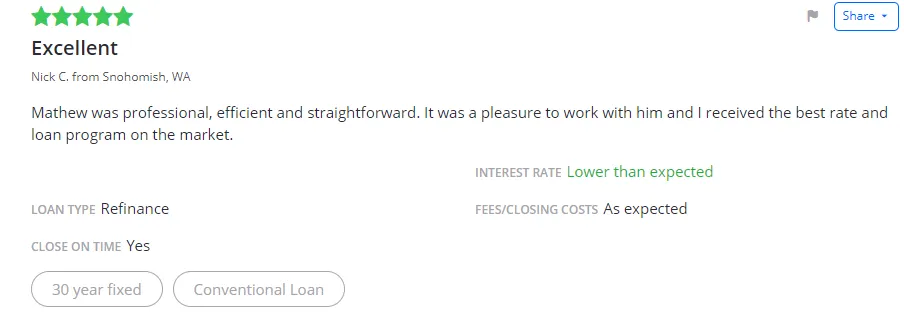

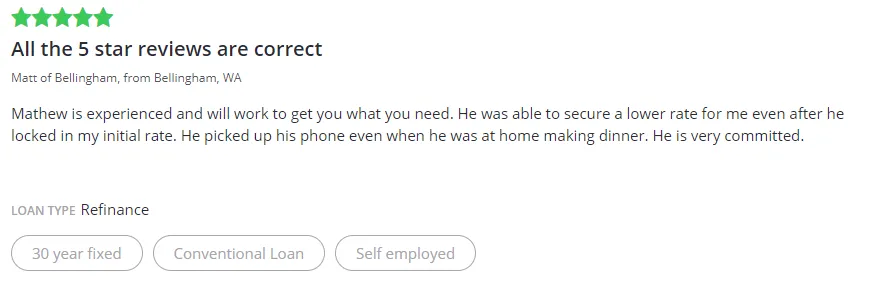

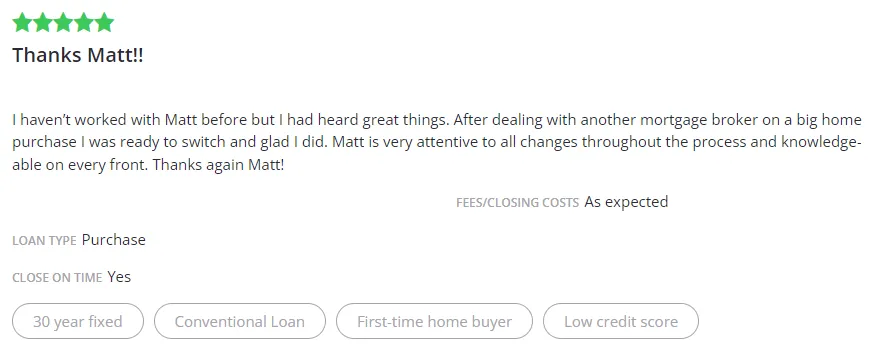

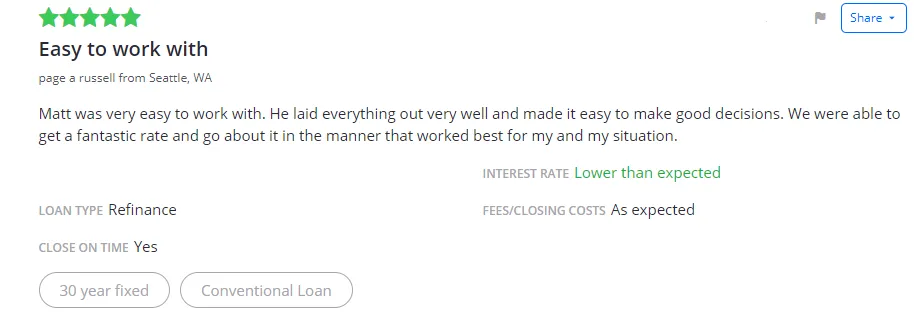

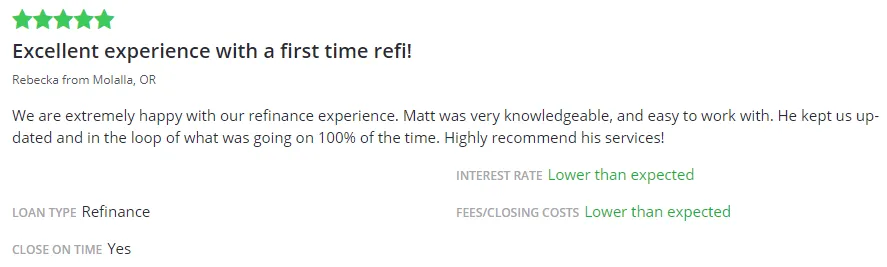

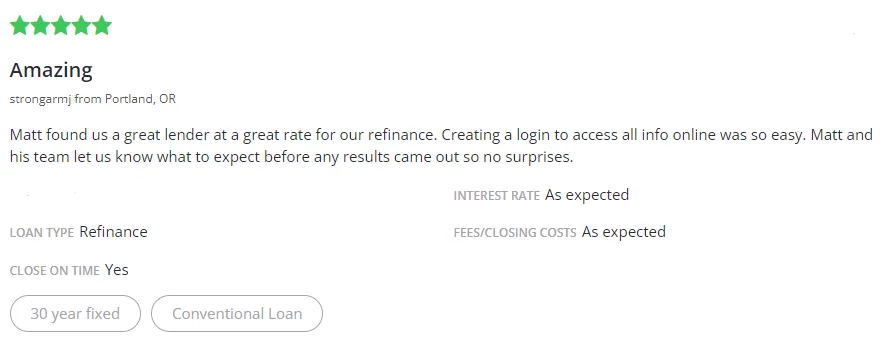

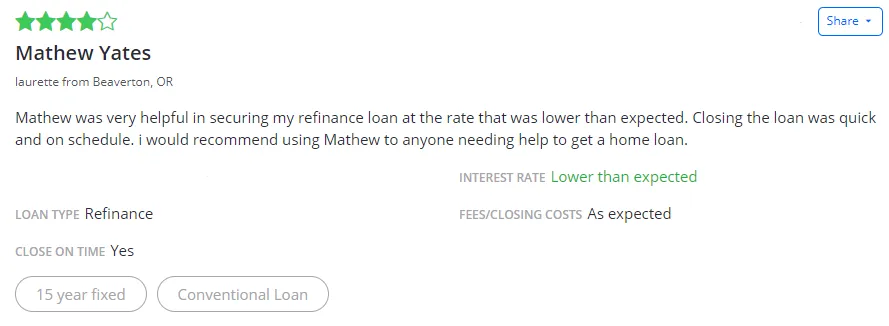

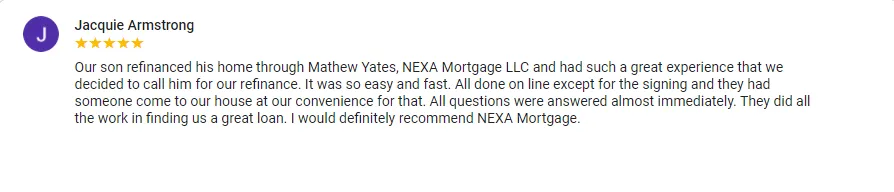

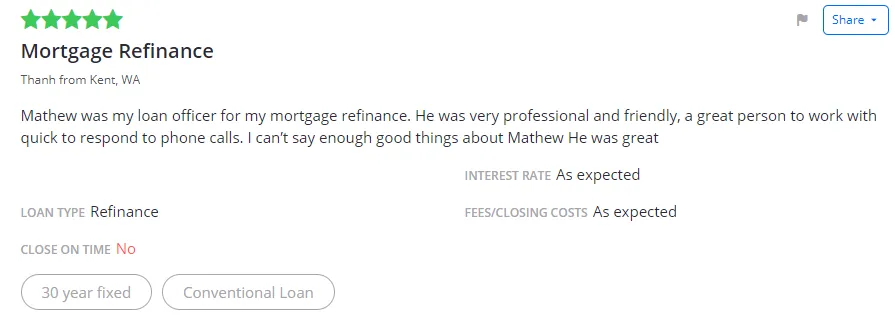

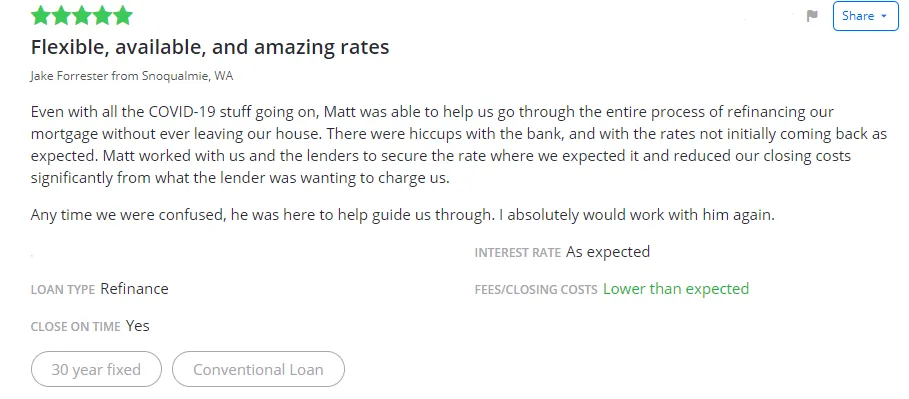

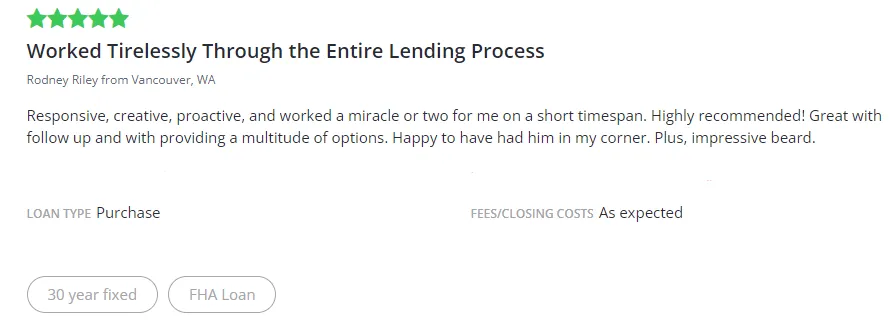

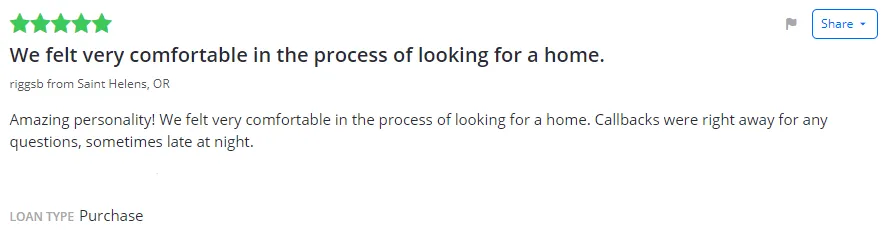

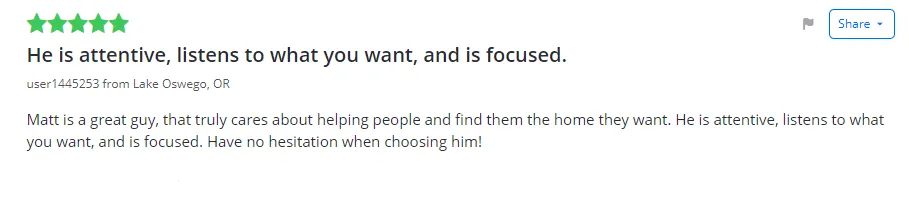

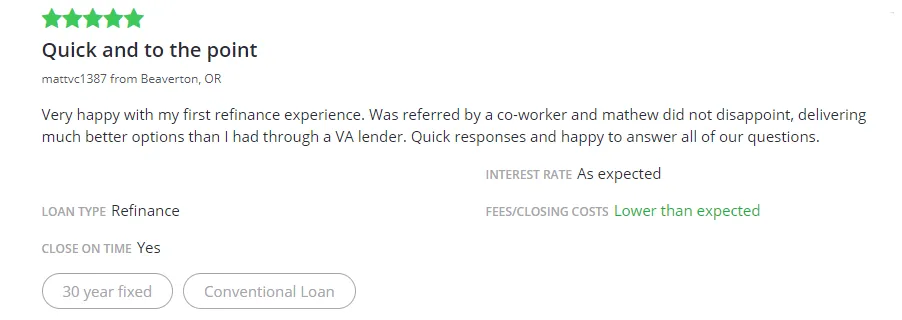

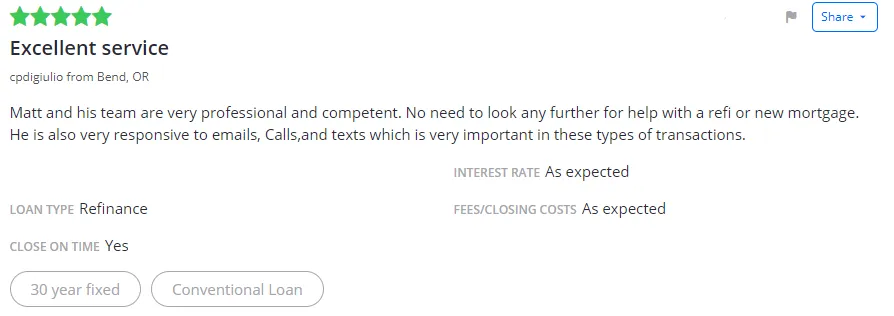

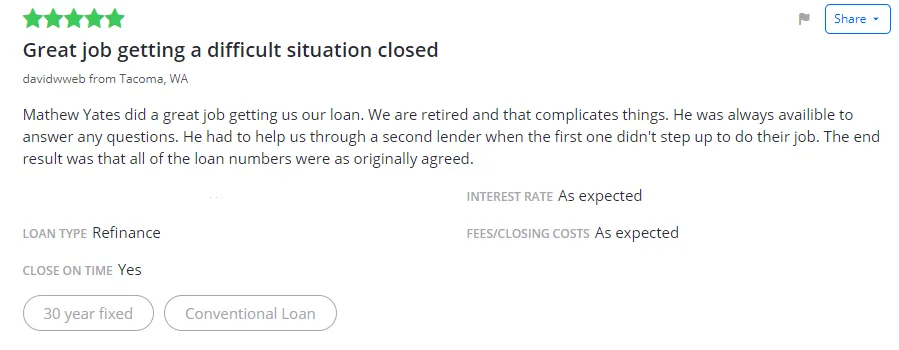

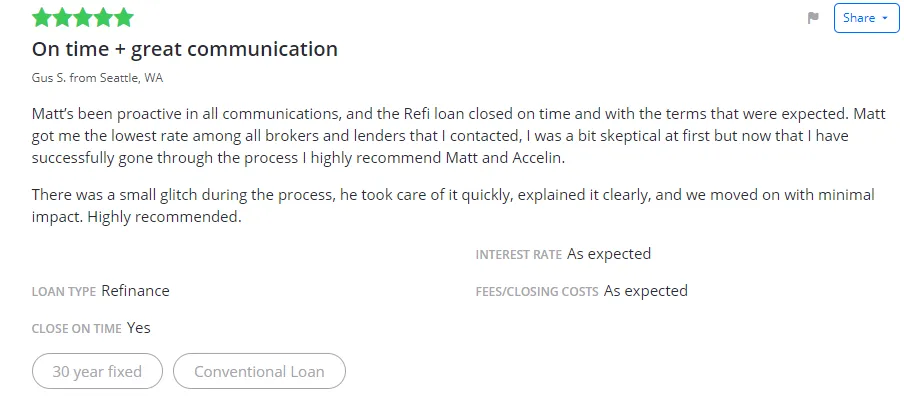

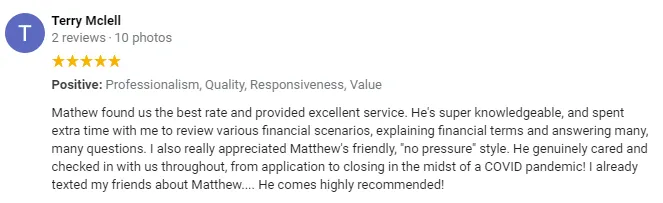

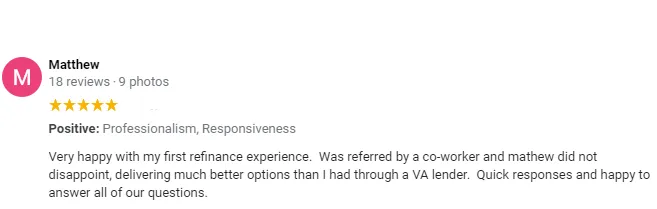

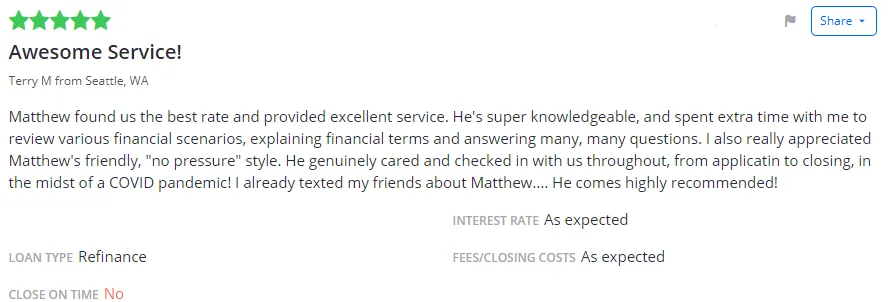

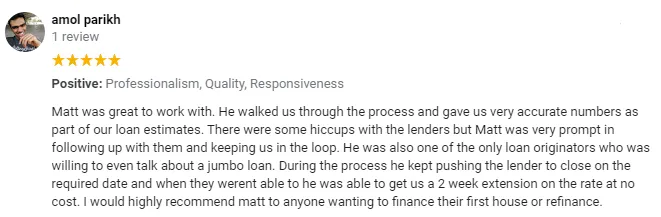

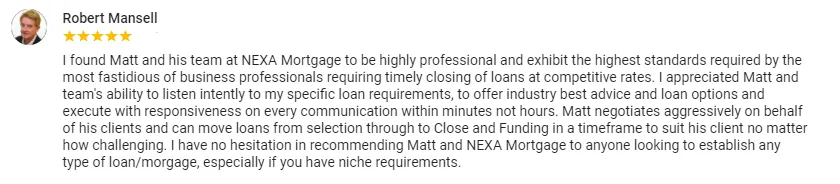

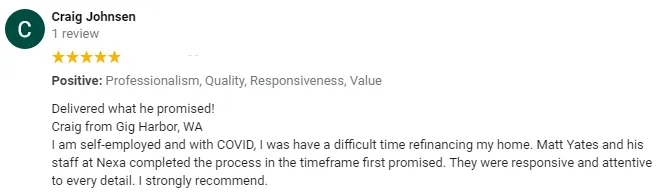

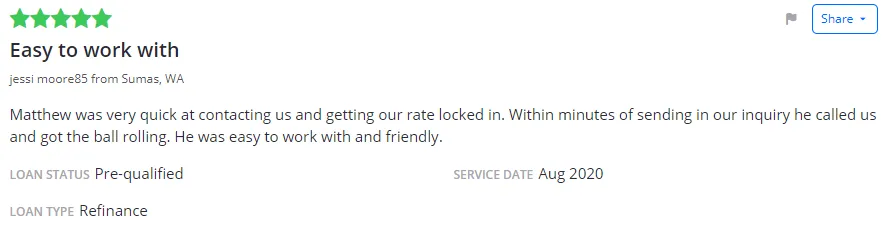

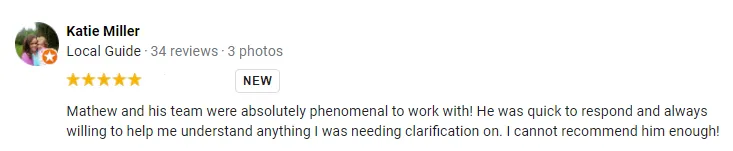

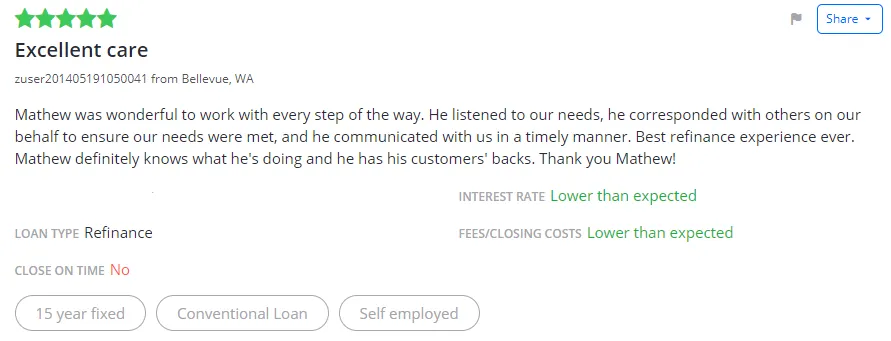

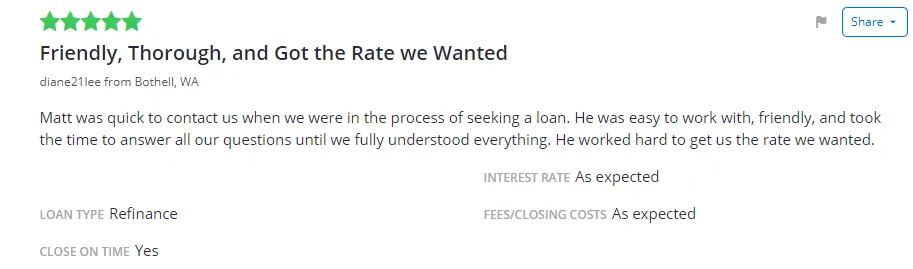

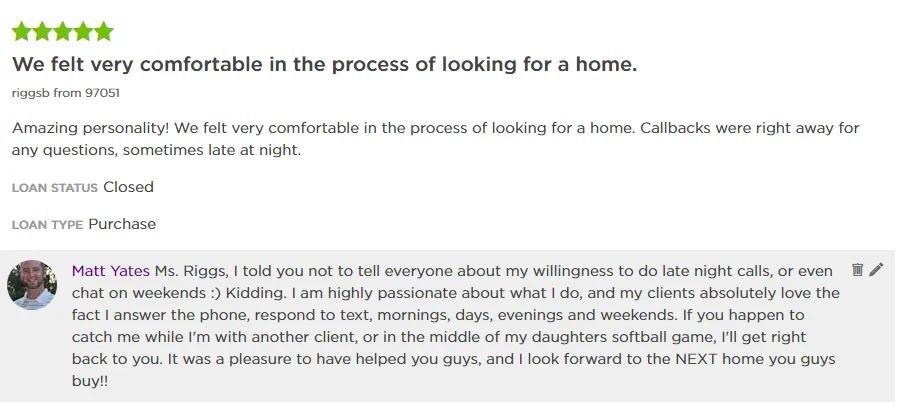

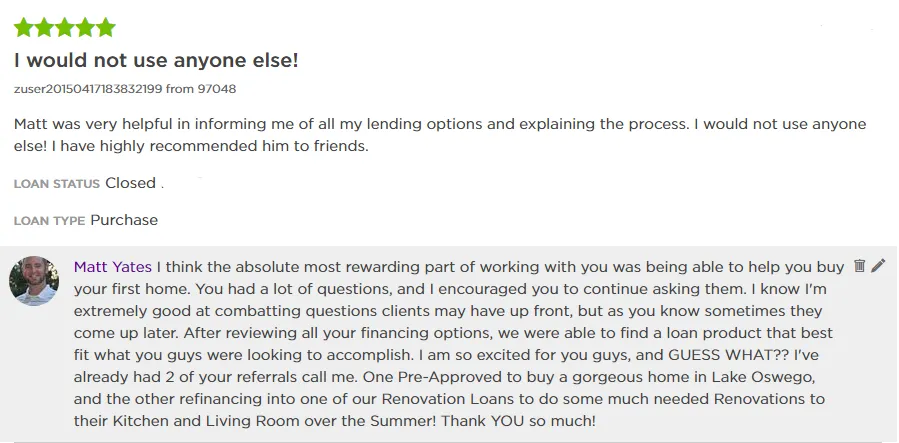

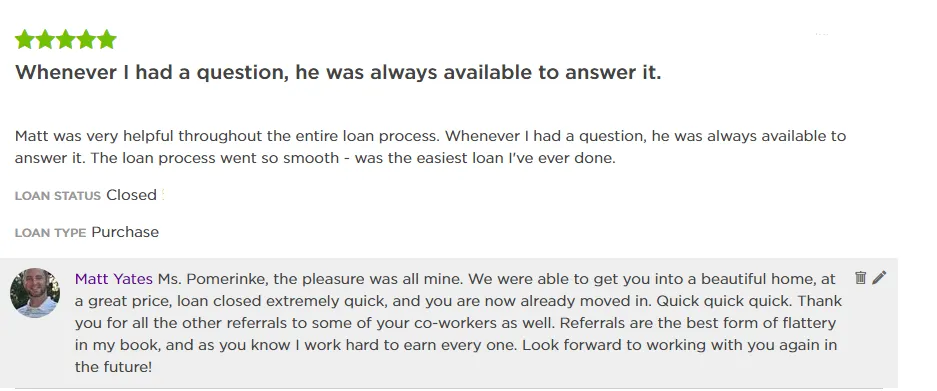

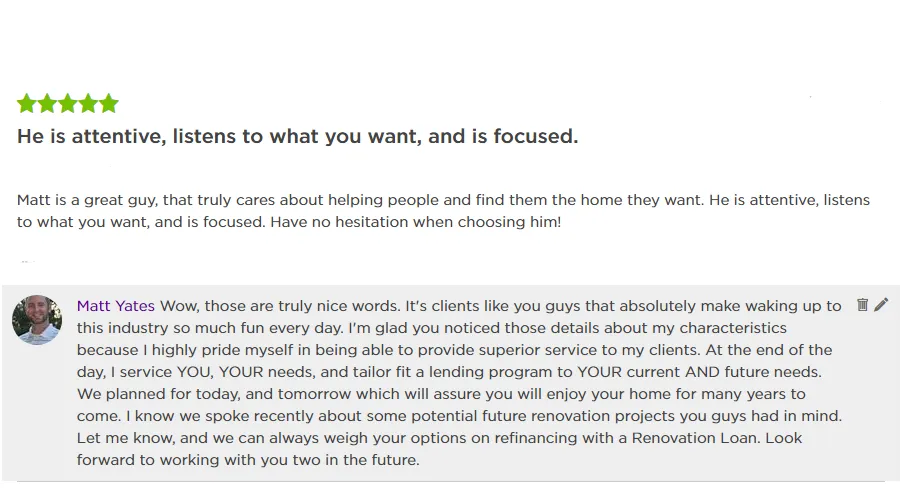

Testimonials

NMLS ID #423065

Contact Me

20225 Water Tower Blvd. Suite 400, Brookfield, WI 53045

NMLS ID #1173903

Novus Home Mortgage, a division of Ixonia Bank is an Equal Housing Lender. We are headquartered at 20225 Water Tower Blvd. Suite 400, Brookfield, WI 53045. Toll free (844) 337-2548. NMLS No. 423065 (www.nmlsconsumeraccess.org). This is not an offer to enter into an agreement or a commitment to lend. All loans are subject to credit approval as well as program requirements and guidelines. Rates and requirements are subject to change without notice. Not all products are available in all states. Other restrictions or limitations may apply. Novus Home Mortgage, a division of Ixonia Bank is not affiliated with any government agency. © Novus Home Mortgage. All Rights Reserved | Program, Rate & APR Examples | Accessibility