What is Mortgage Protection Insurance?

Your Ultimate Guide to Mortgage Protection Insurance and Mortgage Purchase Loans

When it comes to securing your home and future, few financial products are as crucial as mortgage protection insurance and mortgage purchase loans.

Whether you're a first-time homebuyer or looking to refinance, understanding these products can save you money and provide peace of mind. In this comprehensive guide, we’ll delve into everything you need to know, helping you make informed decisions and convert your interest into action.

* Mortgage Protection Insurance is a life insurance policy to protect your family in the unfortunate event of a passing. Helps pay off your mortgage, cover payments, and provides your surviving beneficiaries peace of mind.

It also provides time to grieve, without the added stresses of where income will come from, how mortgage payments will be made, or without having to rush to a sale of the families home during the grieving process. It's the most honorable decision you can make for your surviving beneficiaries.

* Mortgage Protection Insurance is NOT the same as "PMI | Private Mortgage Insurance". PMI is a lender required insurance you have to pay when your home has less than 20% equity.

What is Mortgage Protection Insurance?

When it comes to securing your home and future, few financial products are as crucial as mortgage protection insurance and mortgage purchase loans. Whether you're a first-time homebuyer or looking to refinance, understanding these products can save you money and provide peace of mind.

In this comprehensive guide, we’ll delve into everything you need to know, helping you make informed decisions and convert your interest into action.

✅ What is Mortgage Protection Insurance?

Mortgage protection insurance is a type of life insurance designed to pay off your mortgage in the event of your death. It ensures that your family won’t be burdened with mortgage payments, potentially losing the home they cherish.

✅ Benefits of Mortgage Protection Insurance

Financial Security: Provides financial stability to your family, ensuring they can stay in their home.

Peace of Mind: Knowing your mortgage is covered can reduce stress and allow you to focus on other important aspects of life.

Affordable Rates: Often, these policies are more affordable than traditional life insurance policies.

✅ Why You Need Mortgage Protection Life Insurance?

If you have a mortgage, particularly a sizable one, mortgage protection life insurance is a safeguard against unforeseen circumstances. It’s an investment in your family's future, offering security that your home will remain theirs no matter what happens.

✅ Understanding Mortgage Purchase Loans:

A mortgage purchase loan is the most common way to finance a home purchase. With competitive mortgage purchase loan rates and various terms available, selecting the right loan is crucial.

✅ Types of Mortgage Purchase Loans:

Fixed-Rate Mortgages: These loans have a consistent interest rate throughout the loan term, offering predictable monthly payments.

Adjustable-Rate Mortgages (ARMs): These start with lower rates that adjust periodically based on market conditions.

FHA Loans: Backed by the Federal Housing Administration, these loans are ideal for first-time buyers with lower credit scores.

✅ Finding the Right Mortgage Purchase Loan Company:

Choosing the right mortgage purchase loan company can significantly impact your financial future.

Look for companies with...

Competitive Rates: Compare mortgage purchase loan rates to ensure you’re getting the best deal.

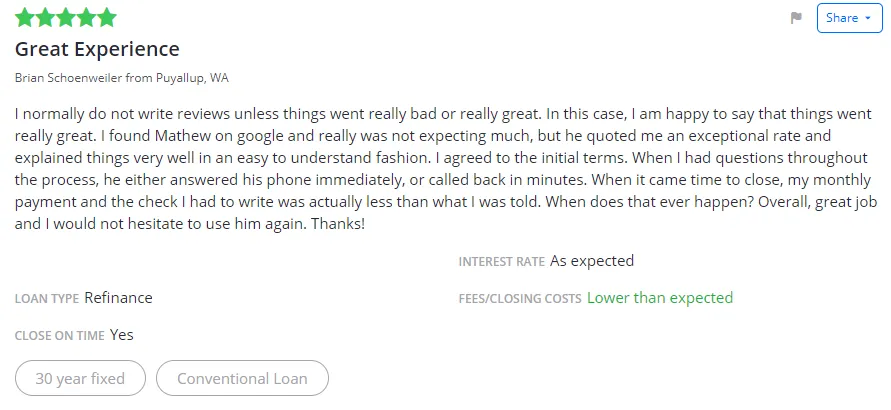

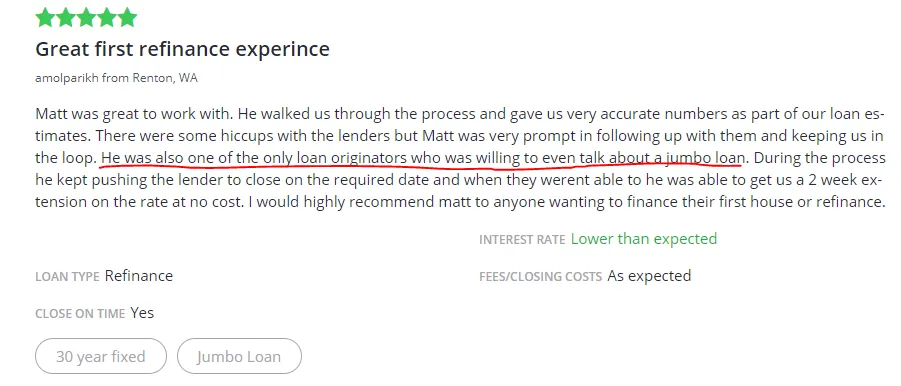

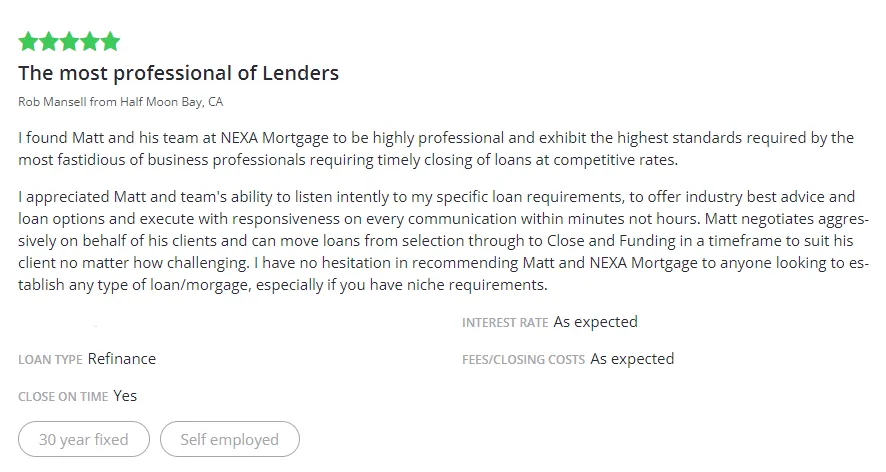

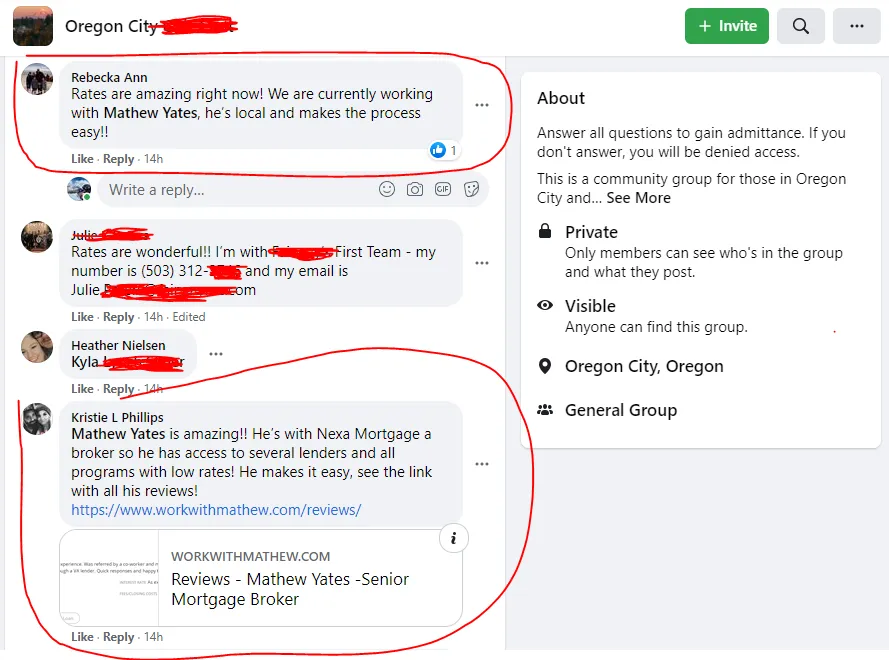

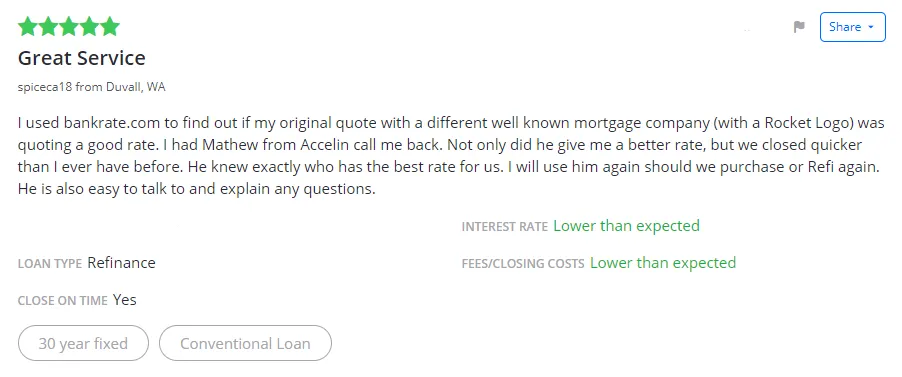

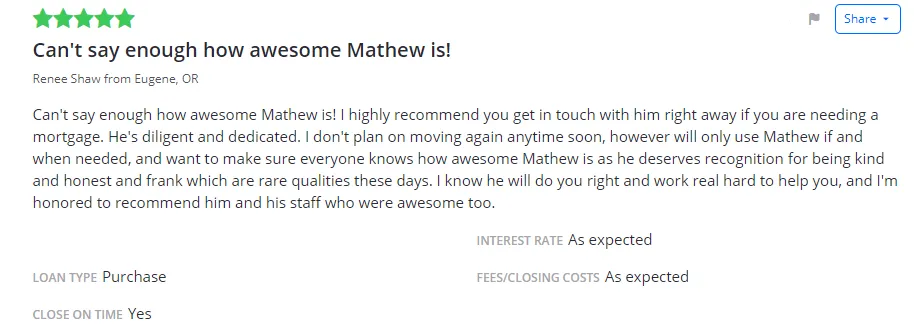

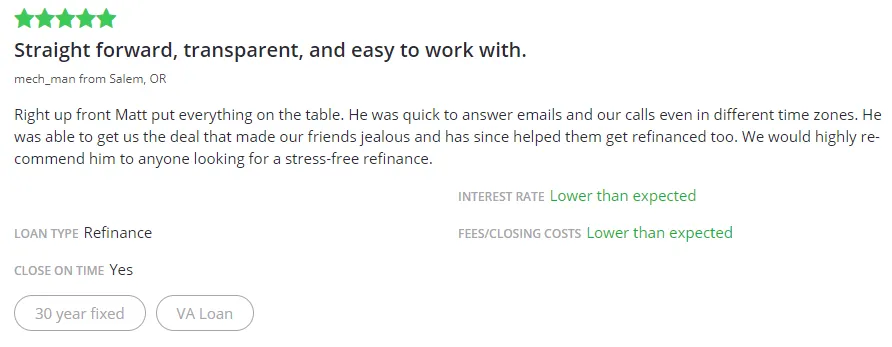

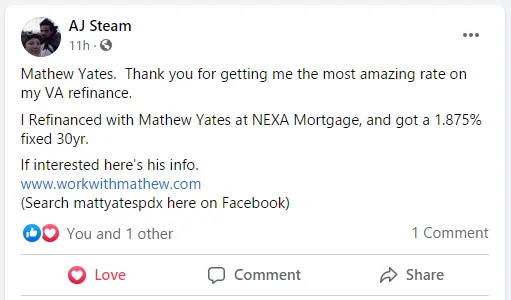

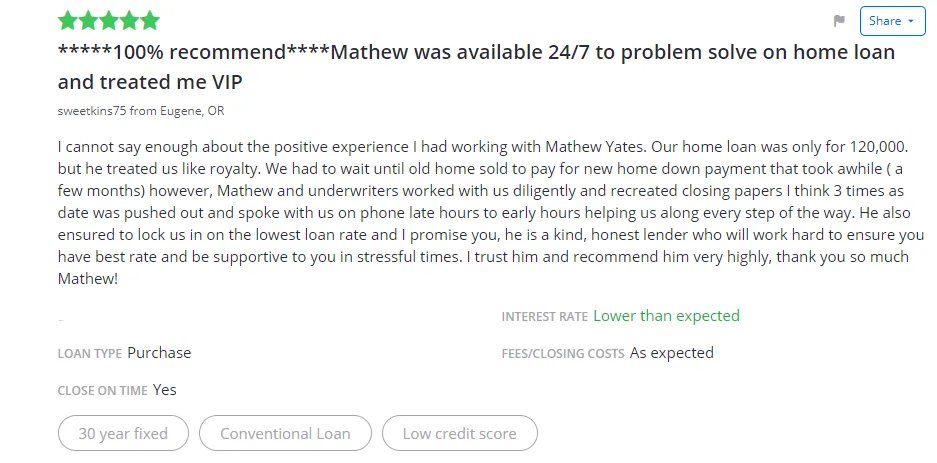

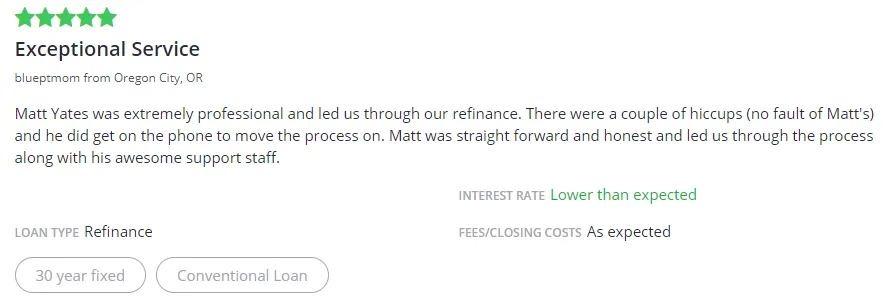

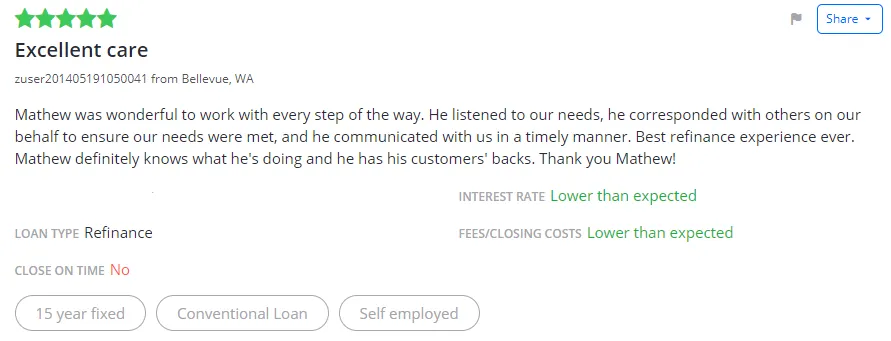

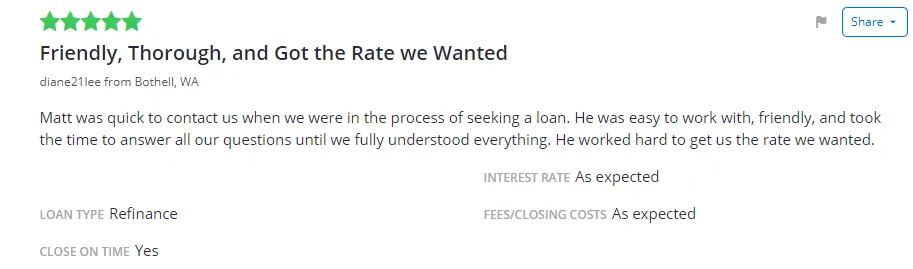

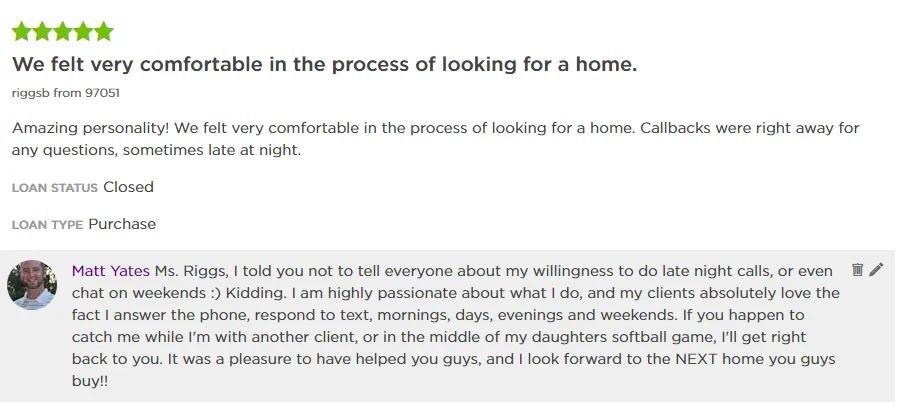

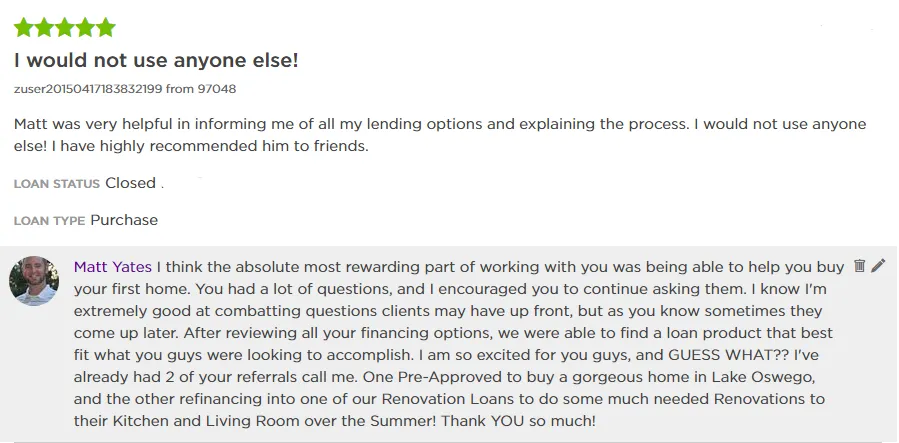

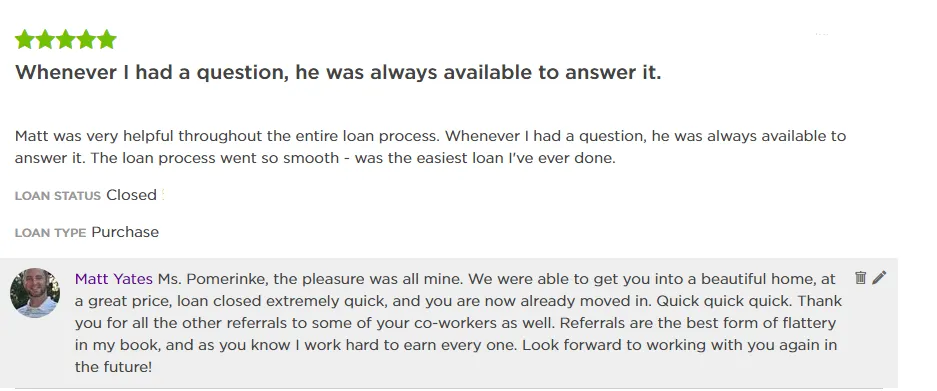

Reputable Service: Customer reviews and ratings can provide insight into the company's reliability.

Flexible Terms: Ensure the company offers loan terms that fit your financial situation.

✅ How to Get the Best Mortgage Purchase Loan Rates

Improve Your Credit Score: Higher credit scores generally qualify for lower interest rates.

Consider a Larger Down Payment: A larger down payment can reduce your loan amount and interest rate.

✅ Finding a Mortgage Lender Near You

We can help in 35+ states. We have local mortgage brokers in ever state we're licensed in.

Click any of the "Get Approved In 15 Minutes" buttons around this page to get started.

✅ The Role of a Mortgage Broker:

A mortgage broker acts as an intermediary between you and potential lenders.

They help you find the best mortgage loan rates and terms based on your financial situation.

✅ Benefits of Using a Mortgage Broker Near You

Access to Multiple Lenders: Brokers have relationships with numerous lenders, increasing your chances of finding the best deal.

Expert Advice: They can provide valuable insights and advice based on extensive industry knowledge.

Time-Saving: Brokers handle the legwork of finding and comparing mortgage loans, saving you time and effort.

✅ Getting a Mortgage Purchase Loan Quote

Obtaining a mortgage purchase loan quote is a crucial step in the home-buying process. It helps you understand potential costs and compare different loan options.

Click any of the "Get Approved In 15 Minutes" buttons around this page to get started.

✅ Steps to Get an Accurate Mortgage Purchase Loan Quote

Gather Financial Information: Lenders will need details about your income, debts, and credit score.

Use Online Tools: Many lenders offer online mortgage loan quote calculators to estimate your costs.

Speak with Lenders: Direct conversations with lenders can provide more accurate and personalized quotes.

✅ The Convenience of Online Mortgage Purchase Loans

In today’s digital age, many lenders offer the option to apply for a mortgage loan online. This process is convenient, efficient, and often faster than traditional methods.

✅ Advantages of Online Mortgage Loans Speed:

Online applications can often be processed quicker.

Accessibility: Manage your application from anywhere, at any time.

Comparison: Easily compare multiple loan offers from different lenders online.

✅ Ready to take the next step?

Get approved in as little as 15 minutes, by selecting the "Get Approved In 15 Minutes" button below.

Approved In As Little As

15 Minutes

IT’S EASY WHEN YOUR CLIENTS HAVE AN INITIAL APPROVAL

Want to feel good about your clients making a strong offer on their dream home?

Get an initial approval for their loan almost instantly

when they work with independent mortgage professionals like us. Our cutting-edge process lets us do what big banks and retail lenders can’t and give them an initial loan approval in as little as 15 minutes — even on the weekends!

It’s especially ideal for your buyers who are self-employed or may have contingencies pop up, clearing the way for a smooth, easy underwriting process.

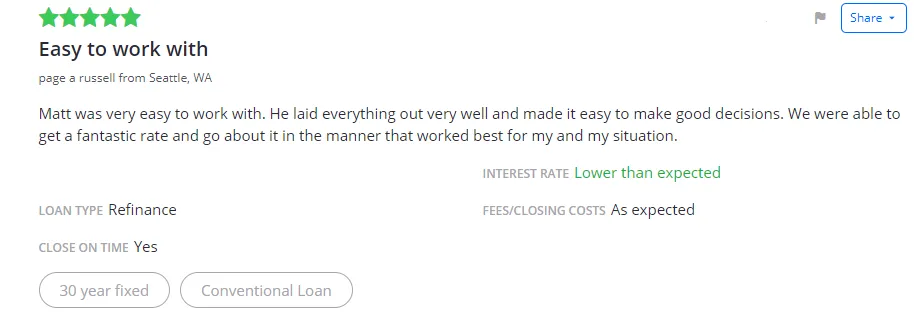

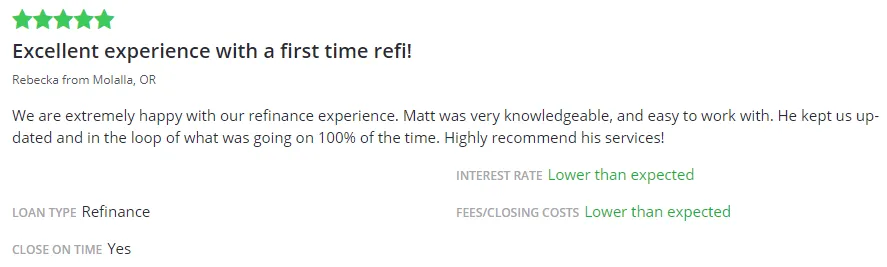

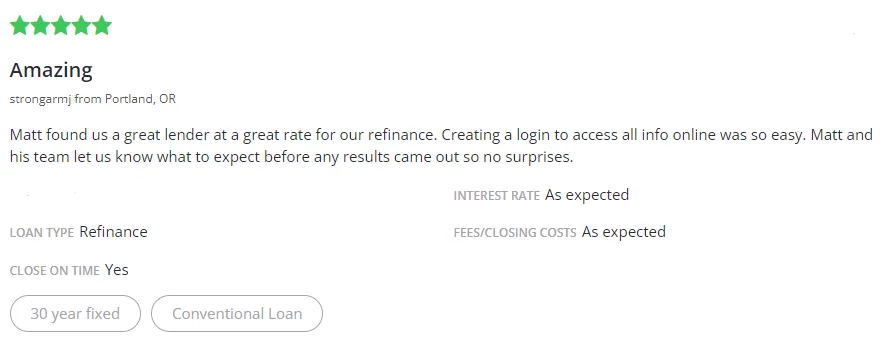

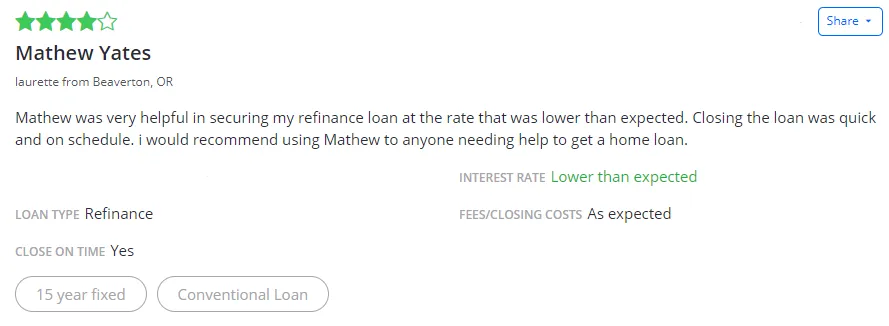

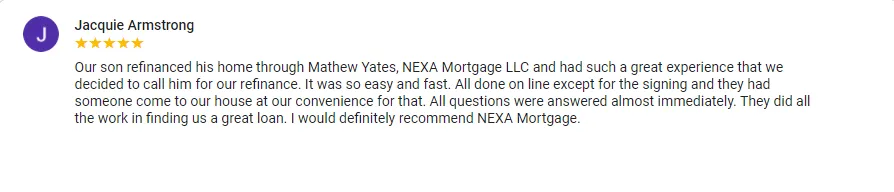

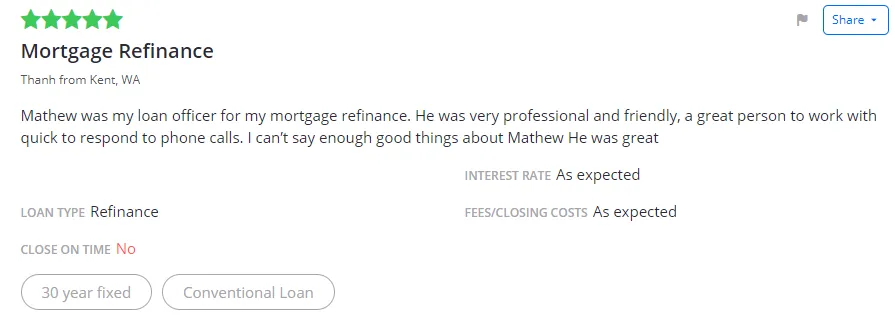

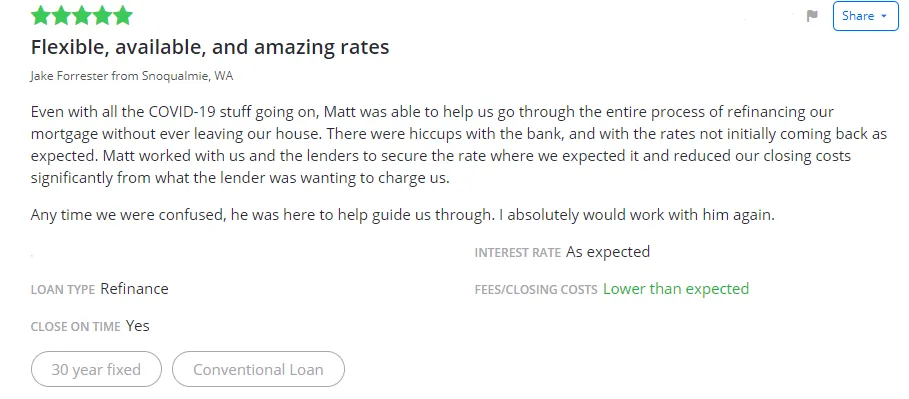

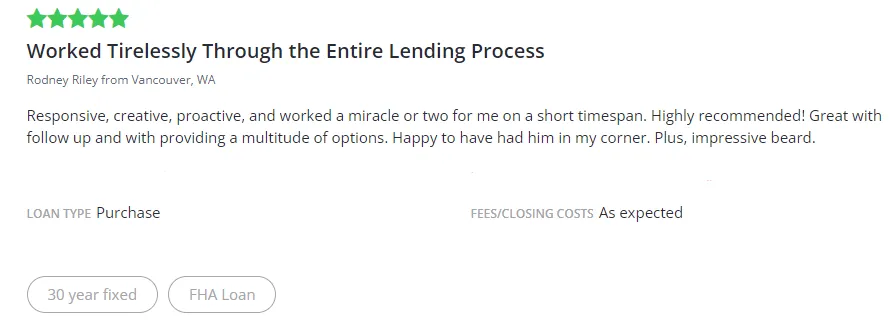

Testimonials

NMLS ID #423065

Contact Me

20225 Water Tower Blvd. Suite 400, Brookfield, WI 53045

NMLS ID #1173903

Novus Home Mortgage, a division of Ixonia Bank is an Equal Housing Lender. We are headquartered at 20225 Water Tower Blvd. Suite 400, Brookfield, WI 53045. Toll free (844) 337-2548. NMLS No. 423065 (www.nmlsconsumeraccess.org). This is not an offer to enter into an agreement or a commitment to lend. All loans are subject to credit approval as well as program requirements and guidelines. Rates and requirements are subject to change without notice. Not all products are available in all states. Other restrictions or limitations may apply. Novus Home Mortgage, a division of Ixonia Bank is not affiliated with any government agency. © Novus Home Mortgage. All Rights Reserved | Program, Rate & APR Examples | Accessibility