Multi-Family Loans - House Hack

LEVERAGE FANNIE MAE'S NEW 5% DOWN MULTI-FAMILY LOAN PROGRAM

THERE’S NO BETTER WAY TO HOUSE HACK YOUR WAY INTO A FUTURE INVESTMENT PROPERTY!

Typically, someone looking to buy a multi-family property as an owner-occupied residence would need to put down 15% - 25% to get a Conventional multi-family loan. Now Fannie Mae offers the 5% down loan.

Live in one of the units and rent out the others!

You can move out and rent in 1 year.

✅ Min FICO credit score of 620

✅ No Upfront Mortgage Insurance Premium

✅ 0.29% (2 Units) - 0.67% (3-4 Units) Monthly Private Mortgage Insurance

✅ Available on Primary residence only

✅ As little as 6 months reserves required

✅ Loan Limits: Low - High-Cost Areas: $981,500 - $2,211,600

Impact on Upfront MIP + Annual Mortgage Insurance

FHA

Home Price $785,000

3.5% Down $27,475

Loan Amount $757,525

Upfront MIP $7,575

Monthly MIP $470

Total Down $35,050

FNMA

Home Price $785,000

5% Down $39,250

Loan Amount $745,750

Upfront MIP $0.00

Monthly MIP $180

Total Down $39,250

With the lesser down payment requirement, the FHA loan would be

$4,200 less in cost difference. However, the Annual Mortgage Insurance Premium

that is paid monthly is $290 more expensive.

If you take your cost difference of $4,200 divided by monthly savings of $290

that is a 14 month break even period. After that, you're saving $3,980 a year!

BONUS: Conventional Private Mortgage Insurance (PMI) automatically falls off upon having 20% or greater equity in the property. This could happen quickly with market upturns. Unlike FHA, you are not required to "refinance" to get out of the insurance.

Refinancing adds more expenses in fees, AND resets your mortgage + front loaded interest.

Approved In As Little As

15 Minutes

IT’S EASY WHEN YOU HAVE AN INITIAL APPROVAL

Want to feel good about making a strong offer on your dream home?

Get an initial approval for your loan almost instantly

when you work with independent mortgage professionals like us. Our cutting-edge process lets us do what big banks and retail lenders can’t and give you an initial loan approval in as little as 15 minutes — even on the weekends!

You’ll also enjoy greater transparency so you can gather any paperwork you need ahead of time and make sure your loan goes through as smoothly as possible.

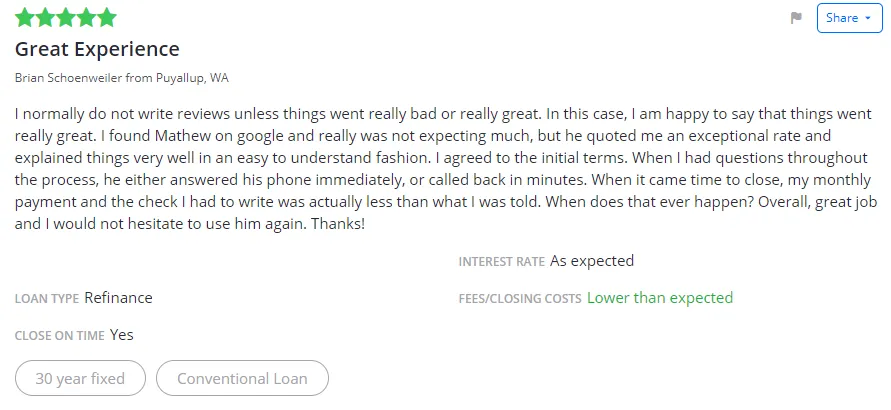

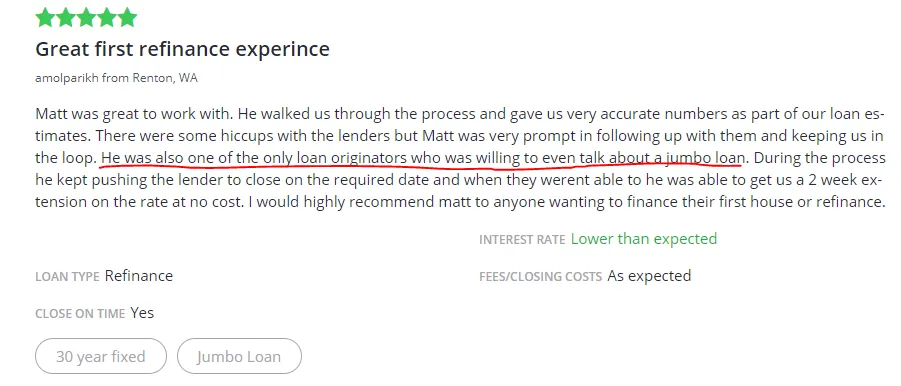

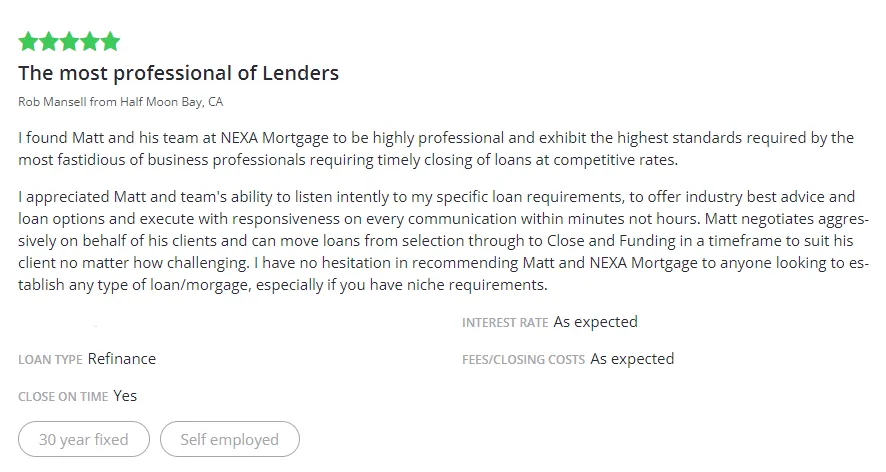

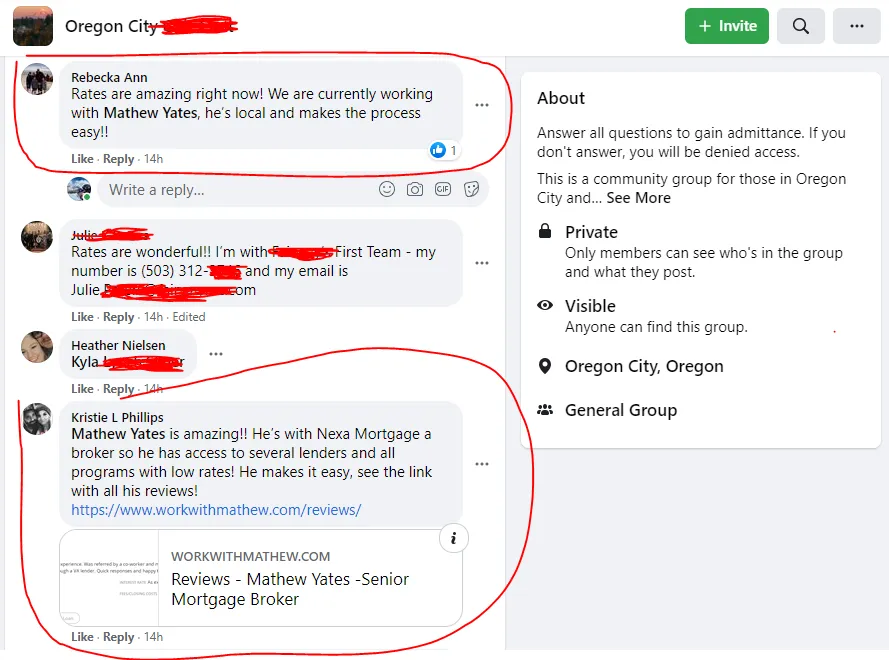

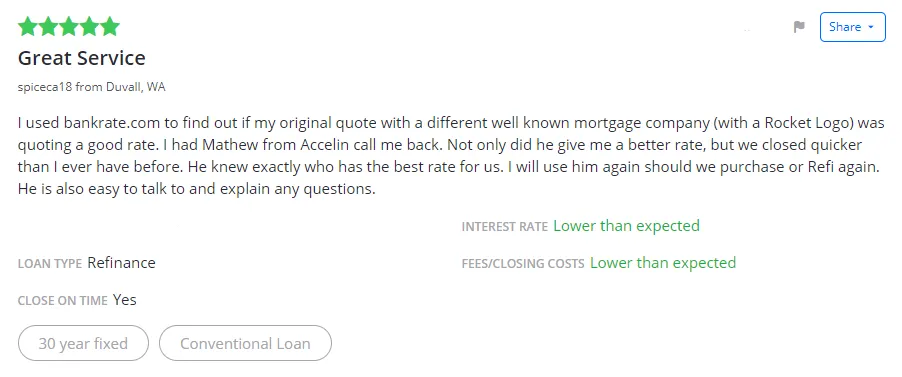

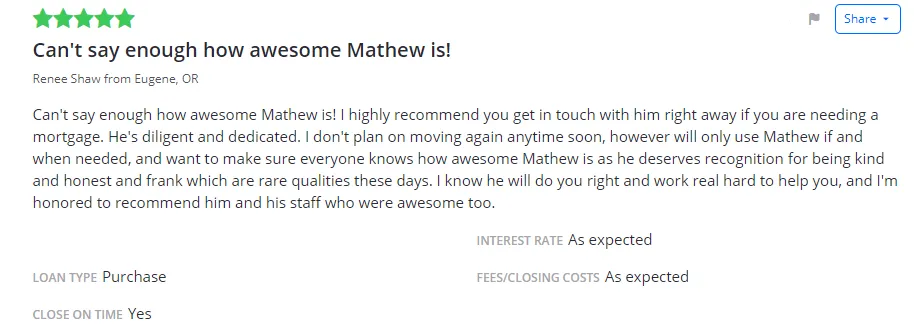

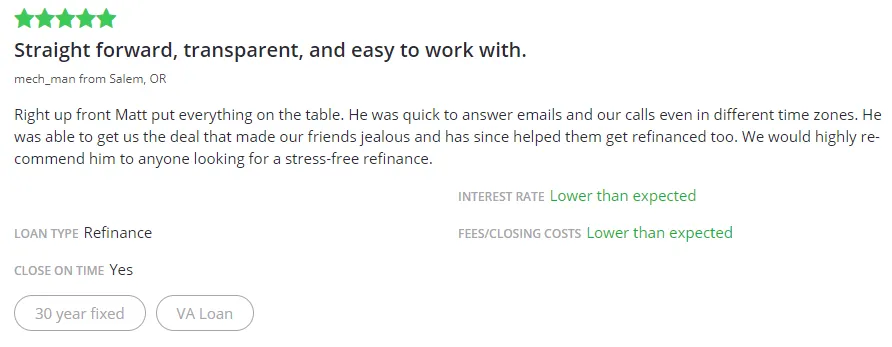

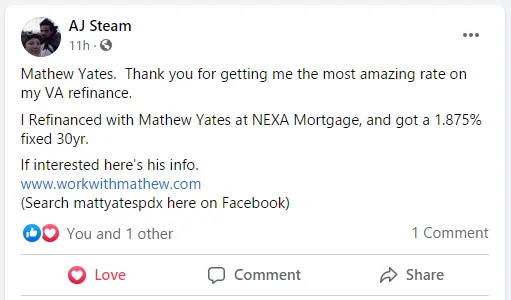

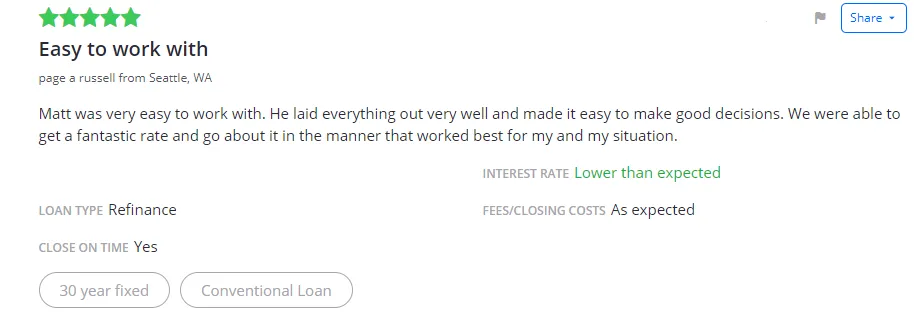

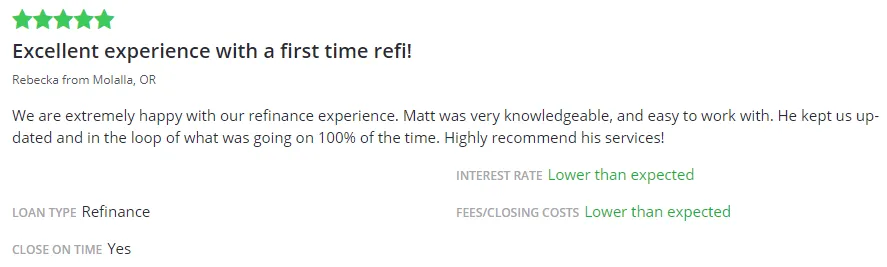

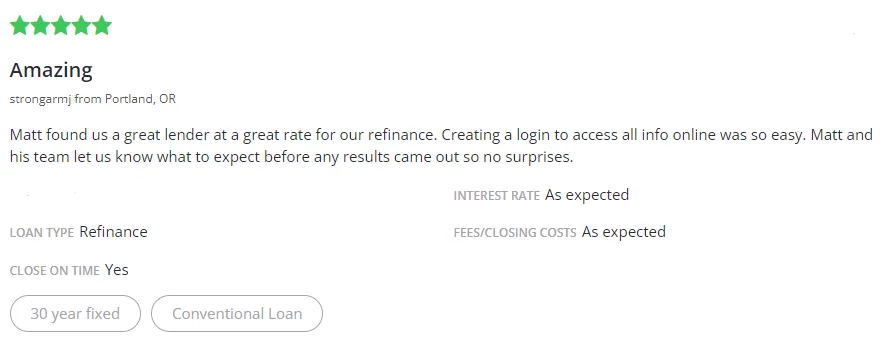

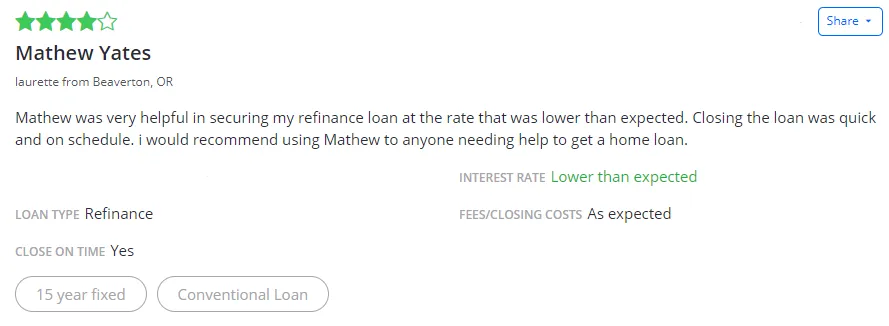

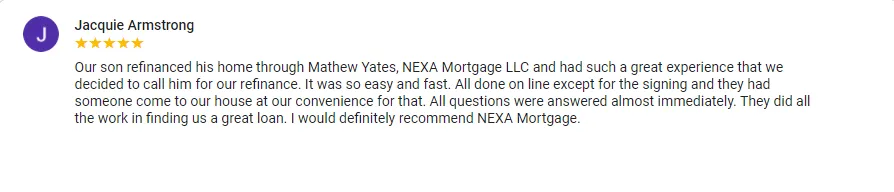

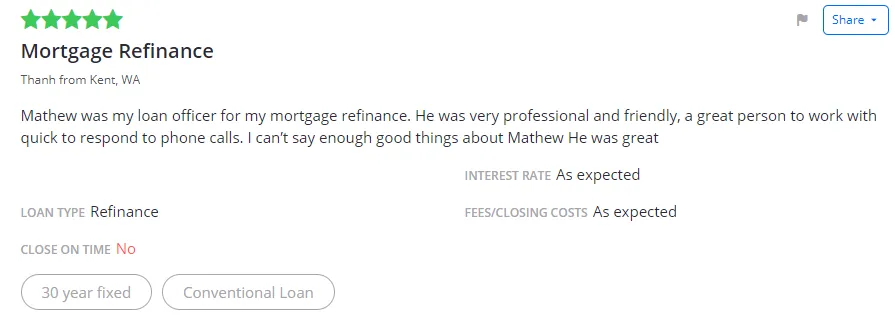

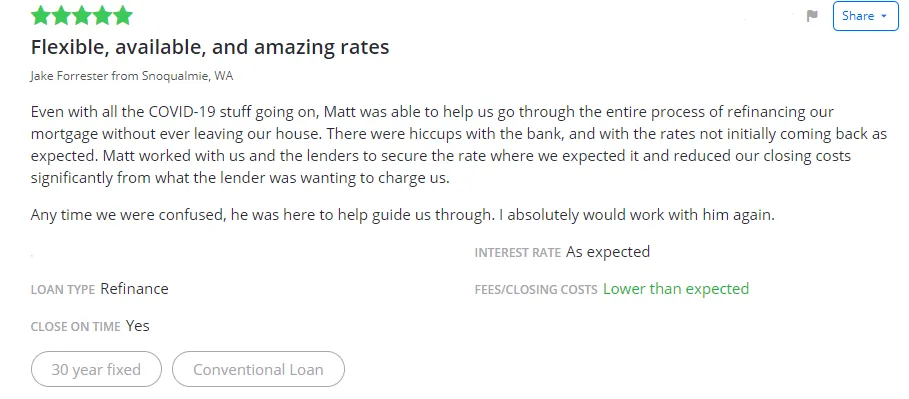

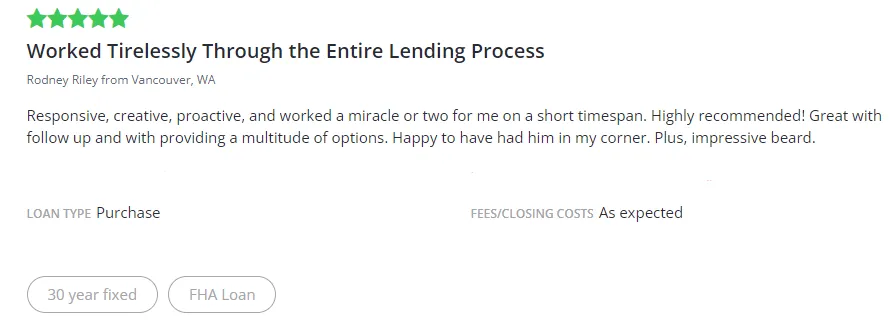

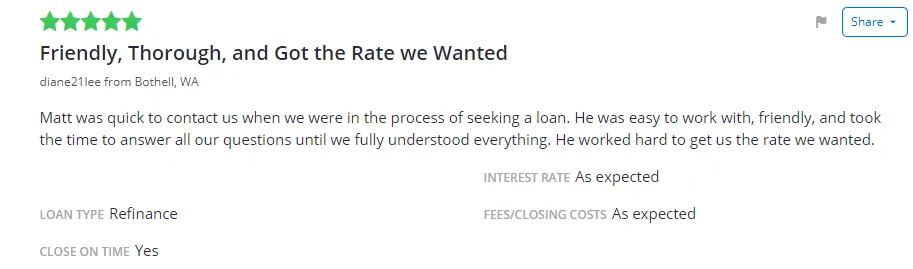

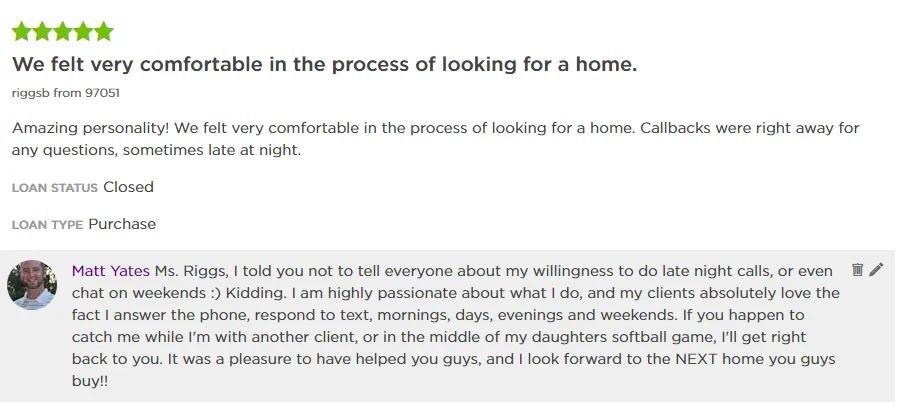

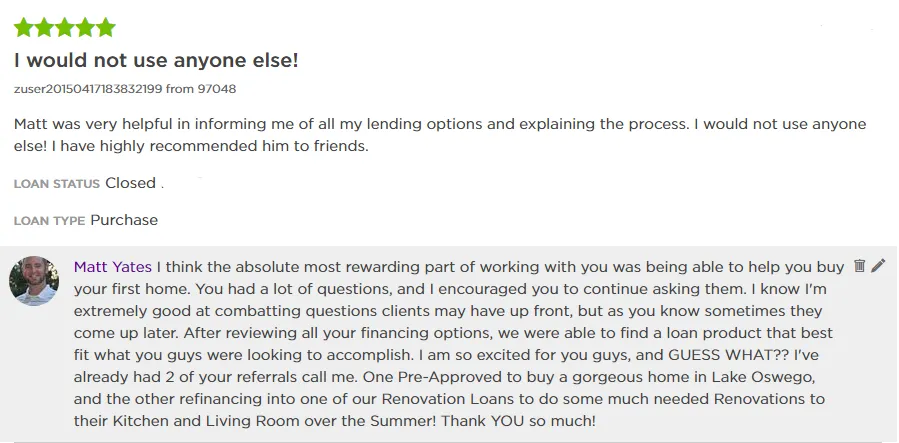

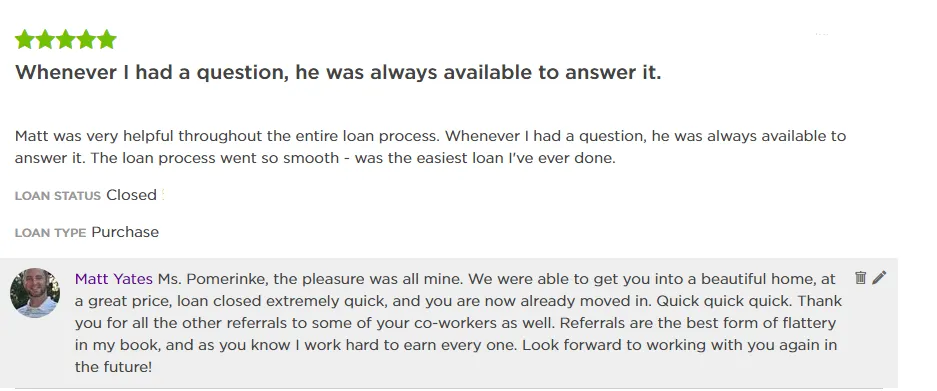

Testimonials

NMLS ID #423065

Contact Me

20225 Water Tower Blvd. Suite 400, Brookfield, WI 53045

NMLS ID #1173903

Novus Home Mortgage, a division of Ixonia Bank is an Equal Housing Lender. We are headquartered at 20225 Water Tower Blvd. Suite 400, Brookfield, WI 53045. Toll free (844) 337-2548. NMLS No. 423065 (www.nmlsconsumeraccess.org). This is not an offer to enter into an agreement or a commitment to lend. All loans are subject to credit approval as well as program requirements and guidelines. Rates and requirements are subject to change without notice. Not all products are available in all states. Other restrictions or limitations may apply. Novus Home Mortgage, a division of Ixonia Bank is not affiliated with any government agency. © Novus Home Mortgage. All Rights Reserved | Program, Rate & APR Examples | Accessibility