50 STATES. ONE TRUSTED PARTNER.

My expertise

I've dedicated my entire adult career to the mortgage industry. 20+ years. I can do all loans, but the niche I love is "creative financing". I primarily work with business owners, entrepreneurs and investors that cannot, or do not want to go the "conventional" financing route, full documentation, etc. I appreciate and love the challenge in structuring these loans. Whether asset based, alt-doc, no doc, or anywhere in between, you've chosen the right growth partner. Let's get started!

Novus Home Mortgage is one of the

largest full-service mortgage companies in the country

that offers extensive options for residential, commercial,

and business financing, with quick service, unmatched communication, and leading rates.

We lend directly, and can broker if needed to over 150 lenders.

PREVIEW OUR LIST OF SERVICES

Alternative Documentation Loans

+ Real Estate Investing

WE OFFER MORE CREATIVE AND ALT-DOC FINANCING OPTIONS THAN ANY OTHER BROKER. RELATIONSHIPS MATTER.

Residential, Multi-Family, Mixed-Use, Commercial

If you're a business owner, 1099 contractor, or real estate investor that's looking for unconventional, or alt-doc lending options that don't require tax returns, I can help. Residential, Commercial, Business financing available in 50 states.

✅ Investor Loans (Debt Service Coverage Ratio)

✅ Pure Bridge Loans | Fix-N-Flip | Ground Up Development

✅ Portfolio & Blanket Loans

✅ Delayed Financing (Get Funds Back After Paying Cash)

✅ Doc-Less Financing (Easy as Sunday Morning)

✅ Bank Statement Loans (12 - 24 Months. No Taxes)

✅ Asset Depletion (Leverage Liquid Assets as Income)

✅ Pure P&L Loans (CPA/EA Letters Accepted)

✅ Can be closed in an LLC (Limited Liability Company)

This is a great opportunity for those looking to get started with rental properties, or have a means to purchase your next primary or second home without having to worry about taxable income.

Approved In As Little As 15 Minutes

IT’S EASY WHEN YOU HAVE AN INITIAL APPROVAL

Want to feel good about making a strong offer on your dream home?

Get an initial approval for your loan almost instantly when you work with independent mortgage professionals like us. Our cutting-edge process lets us do what big banks and retail lenders can’t and give you an initial loan approval in as little as 15 minutes — even on the weekends!

You’ll also enjoy greater transparency so you can gather any paperwork you need ahead of time and make sure your loan goes through as smoothly as possible.

Investor Flex Loans

(Debt Service Coverage Ratio)

THE TIME TO EXPAND YOUR PORTFOLIO IS NOW!

We have a quick and easy way to purchase more investment properties. Our Debt-Service Coverage Ratio (DSCR) loan allows you to qualify for investment properties based on the prospective monthly rental income.

✅ Finance up to 20 properties

✅ Loan amounts up to $3M

✅ Eligible for short-term and long-term rentals

✅ Low reserves requirement (as little as 3 months)

✅ Can be closed in an LLC (Limited Liability Company)

This is a great opportunity for those looking to get started with rental properties, as well as those looking to grow.

✅ Non-retired and retired borrowers are eligible

✅ Not penalized on rates for leveraging your assets

✅ You can couple asset depletion income with other forms of income

✅ 75% maximum loan-to-value ratio (LTV)

✅ All occupancy and collateral types are allowed

✅ Up to 50% debt-to-income ratio (for FICO scores >650)

Asset Depletion Loans

LEVERAGE YOUR LIQUID ASSETS AS INCOME FOR QUALIFYING

An Asset Depletion Loan allows you to use the current cash value of your liquid assets – instead of traditional income sources such as pay stubs and tax returns – to demonstrate your ability to afford timely mortgage payments. This program is ideal for borrowers who have adequate liquid assets but lack traditional employment and/or methods of income verification.

How It Works

With an Asset Depletion Loan, your income is calculated by dividing your total liquid assets over 360 months. Assets that qualify as liquid assets include retirement accounts, investment accounts, checking accounts, savings accounts, stocks, bonds, CDs, etc. You can use 100 percent of your cash and non-retirement investment accounts in calculating your total liquid assets if you are over the age of 59.5, and 70 percent if you are under 59.5.

Delayed Financing Loans

GET YOUR MONEY OUT OF YOUR HOME AND INTO YOUR SAVINGS

✅ Refinance immediately after purchase.

✅ Close your loan in an average of 20 days.

✅ Free up your cash for other expenses or investments.

Doc-Less Loans

GET A FASTER, EASIER MORTGAGE OR REFINANCE WITHOUT THE HASSLE OF GATHERING FINANCIAL DOCUMENTS

Here’s how it works.

✅ You simply e-sign your loan documents

✅ We verify your income, assets and tax returns

✅ We notify you when your loan is approved

Adjustable Rate Mortgages

TODAY'S ADJUSTABLE-RATE MORTGAGES ARE A LOT DIFFERENT THAN THEY WERE IN THE PAST

And they may be the best choice for your purchase or refinance:

ARMs are smarter

✅ Most people only stay in their mortgage for 5 to 7 years. Why not go for the lower rate?

✅ With an ARM, more of your payment goes toward the principal, so you pay down your mortgage faster

ARMs are often safer

✅ ARMs no longer feature pre-payment penalties, so you can easily refinance

ARMs can save you money

✅ A lower rate means a lower payment, which means more cash in your pocket each month

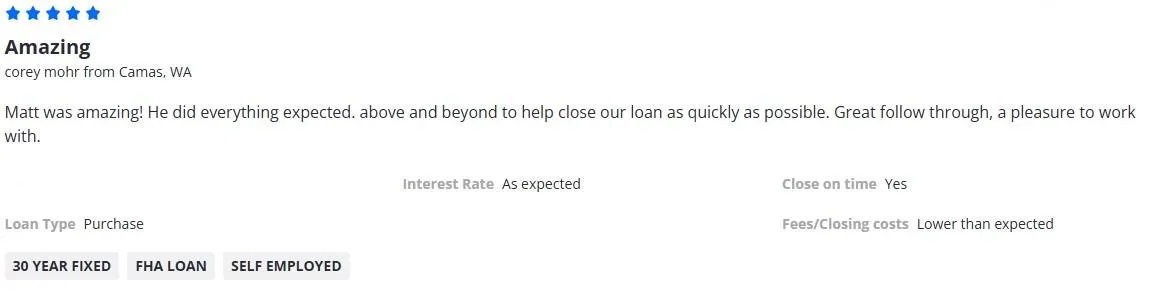

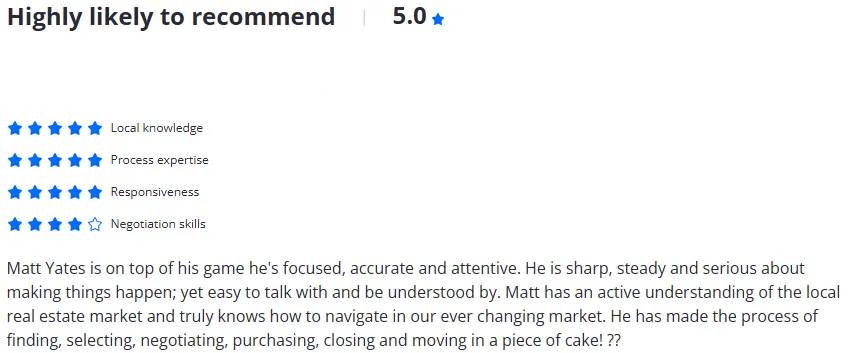

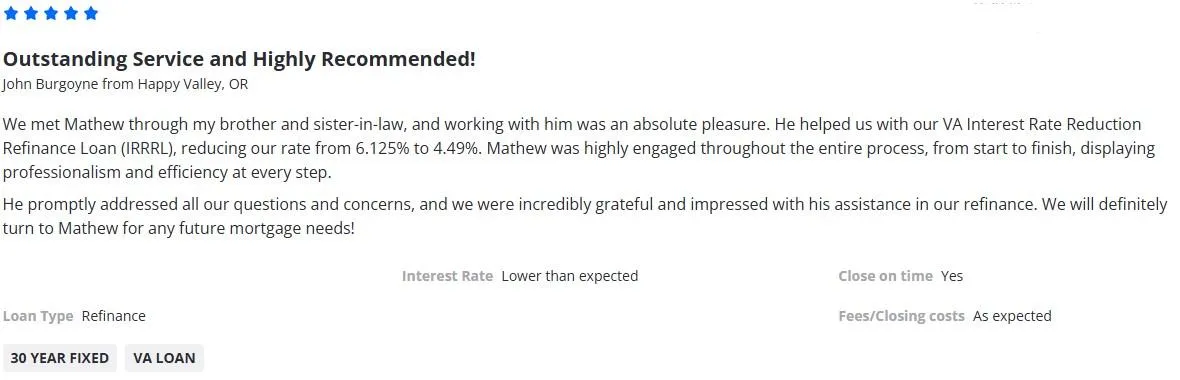

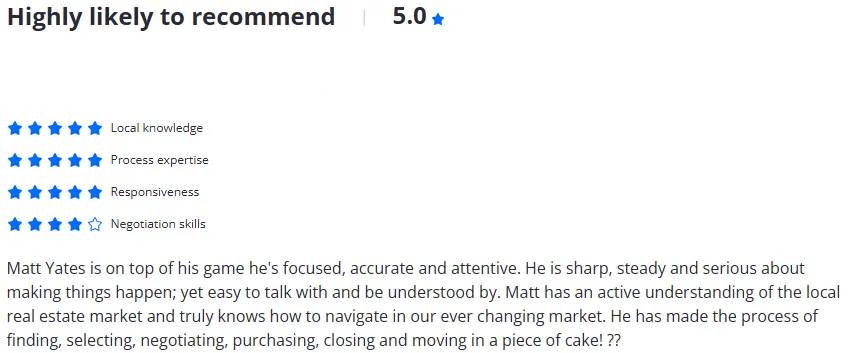

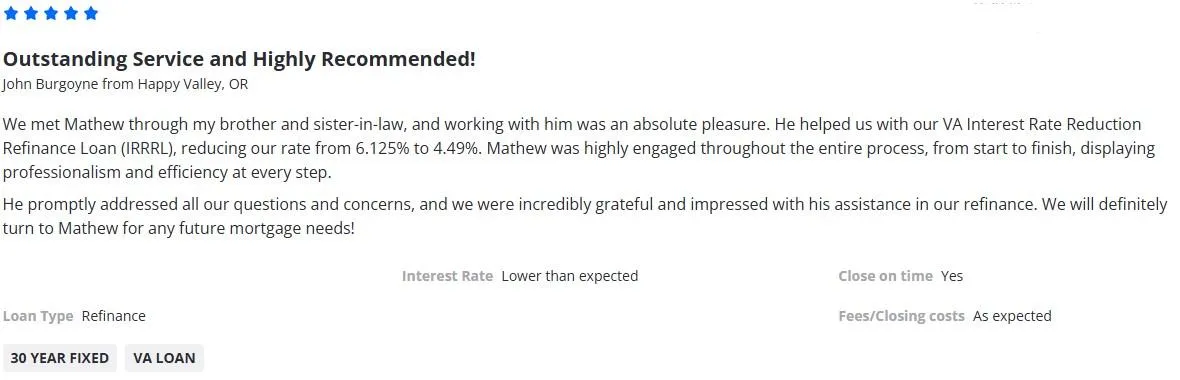

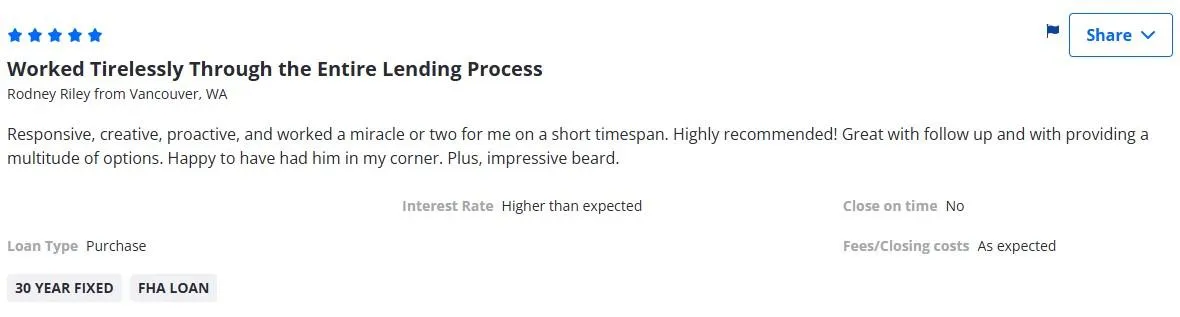

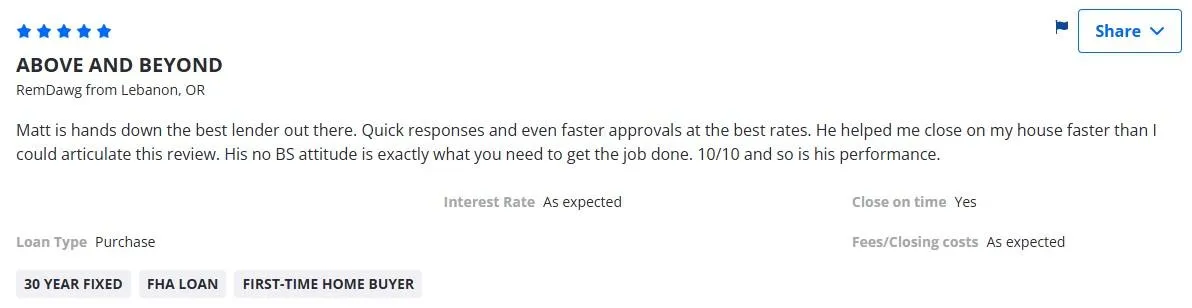

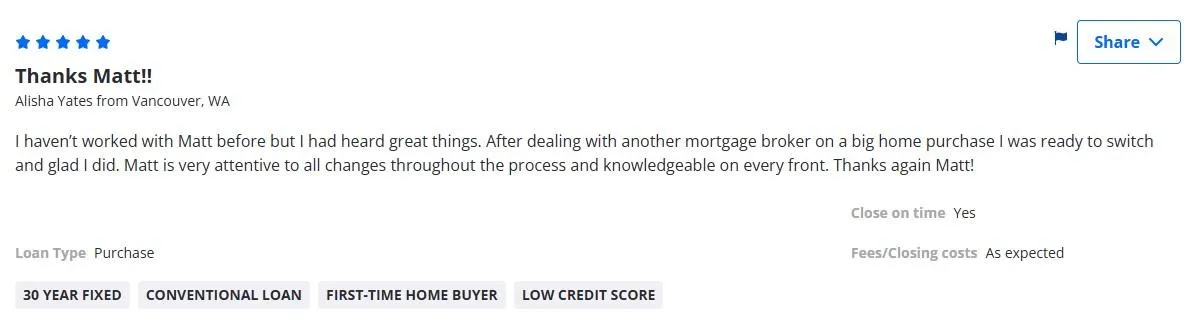

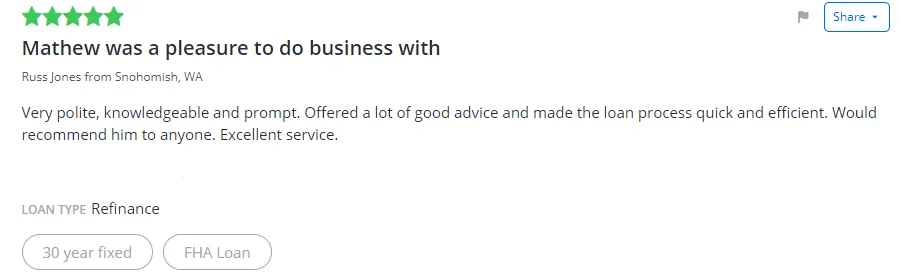

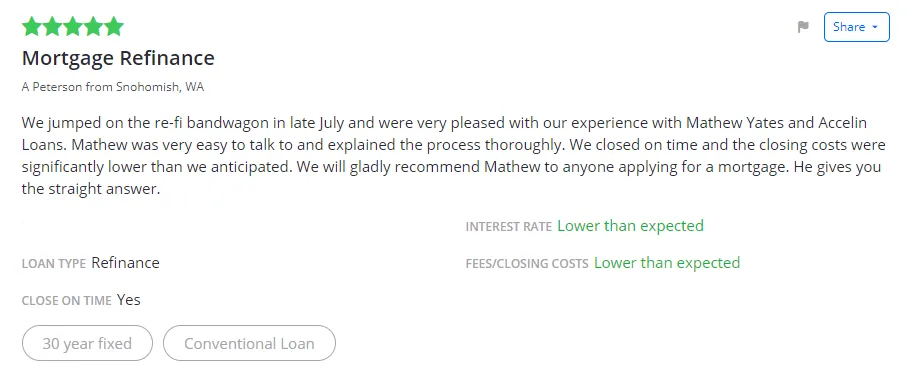

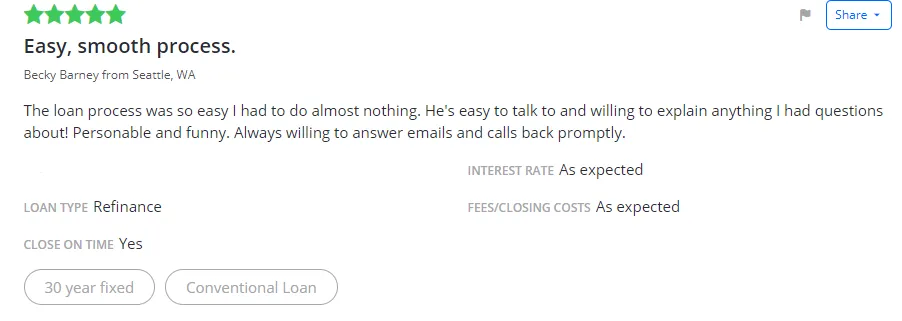

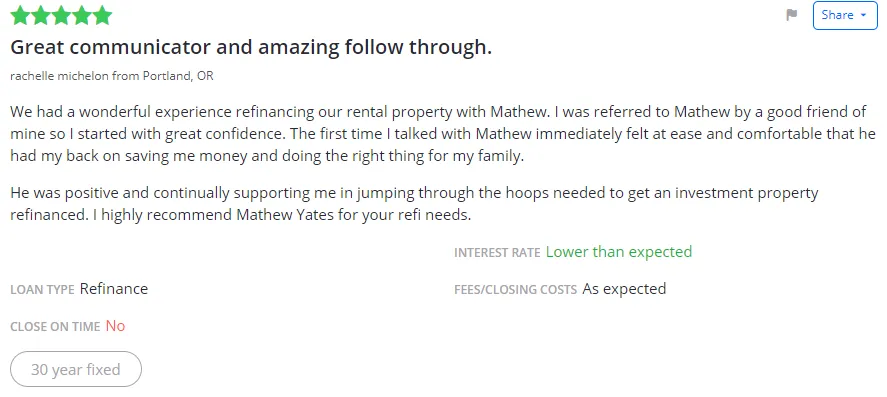

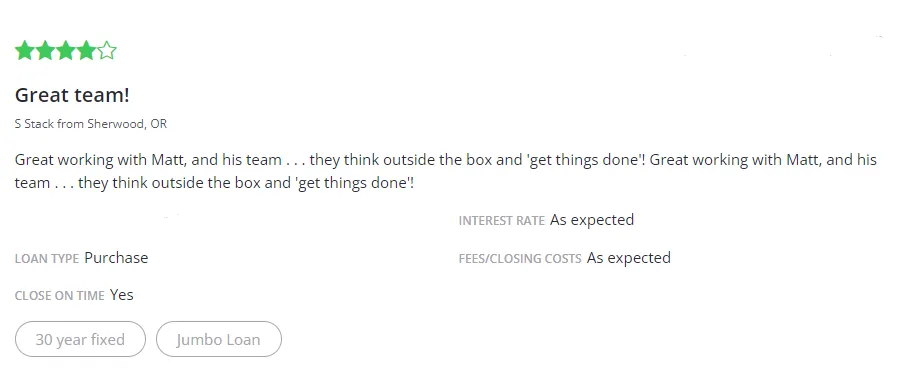

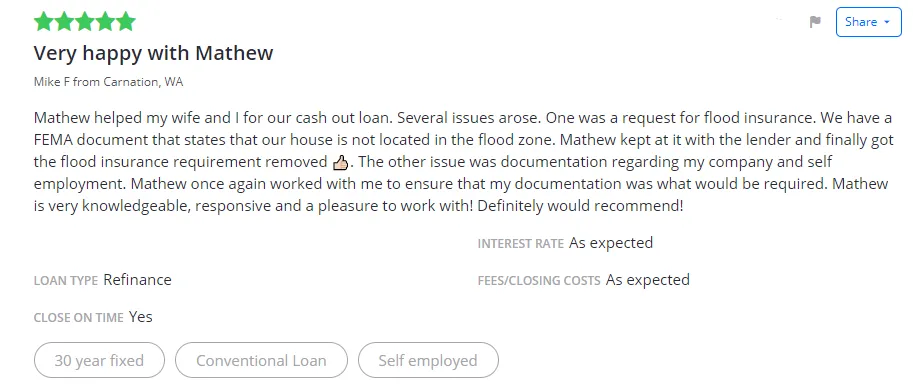

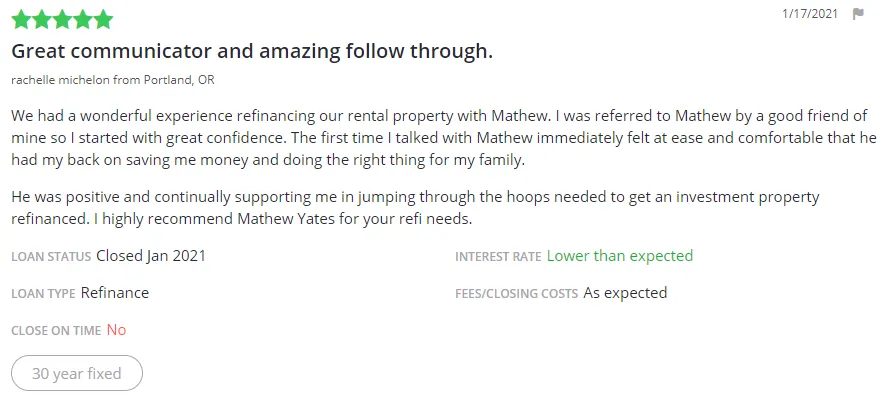

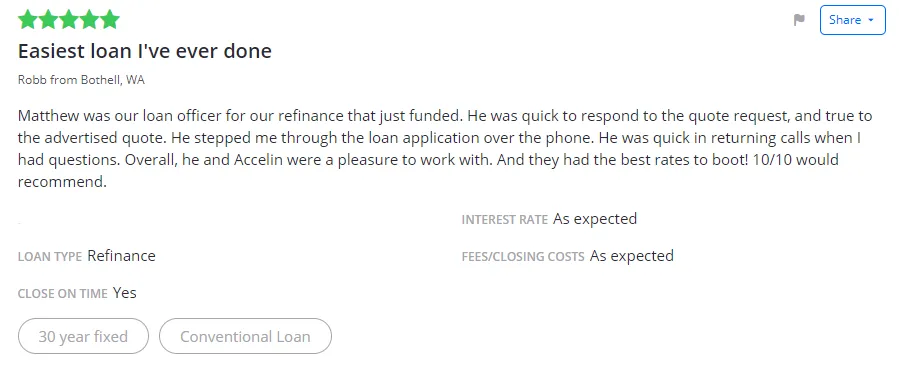

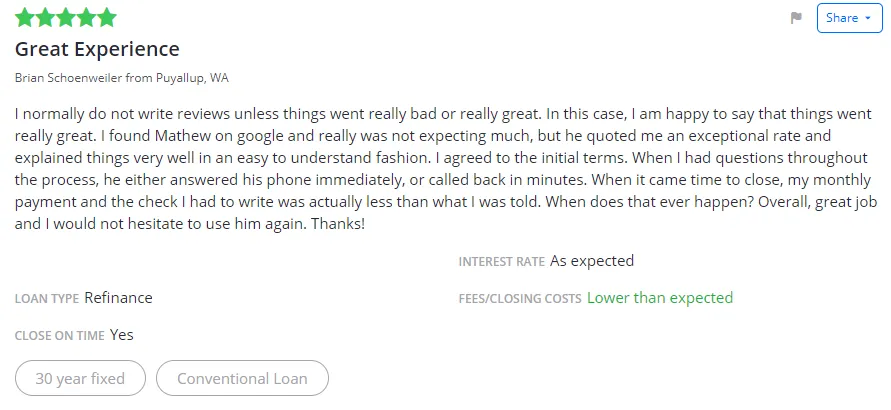

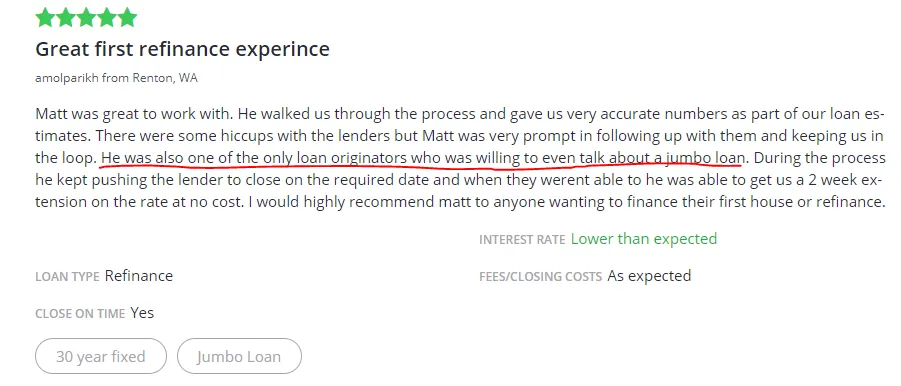

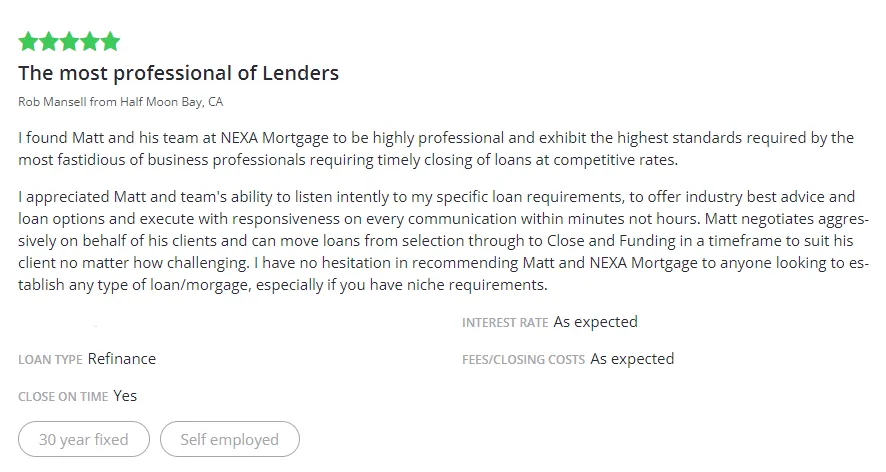

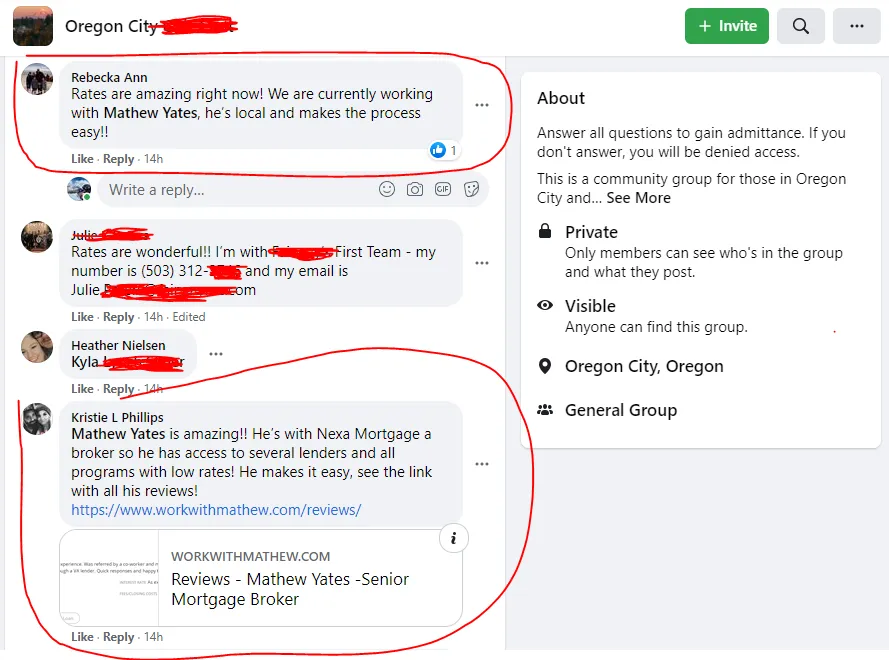

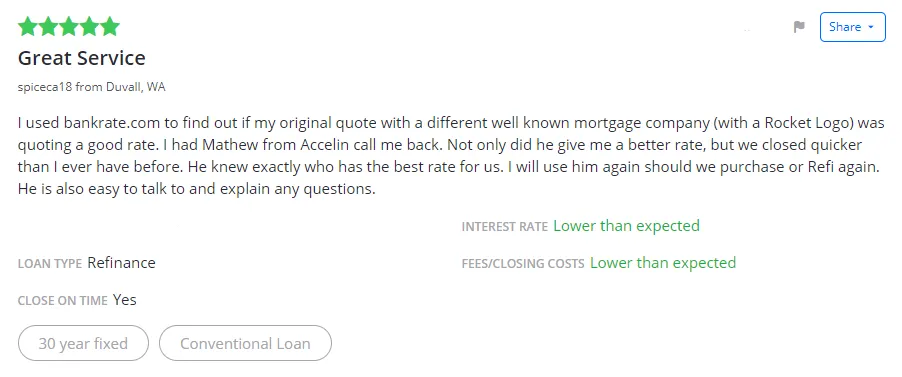

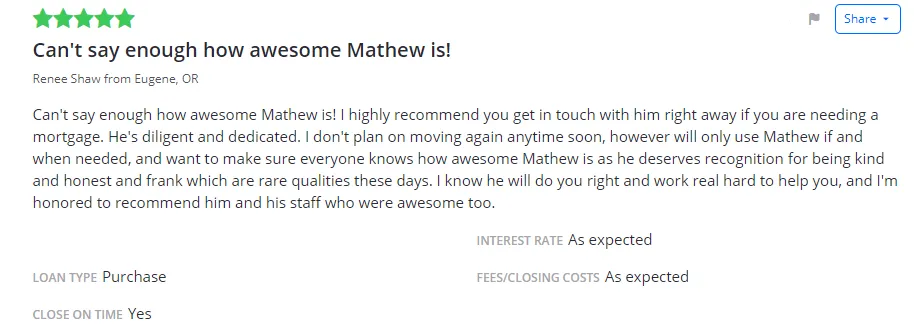

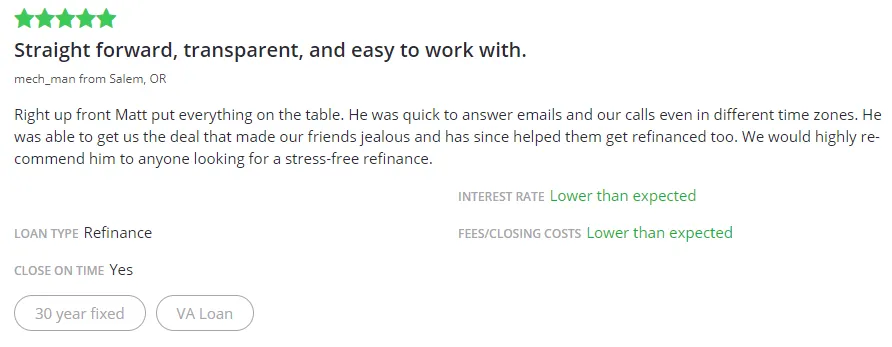

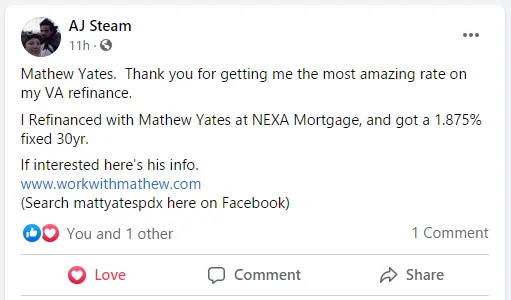

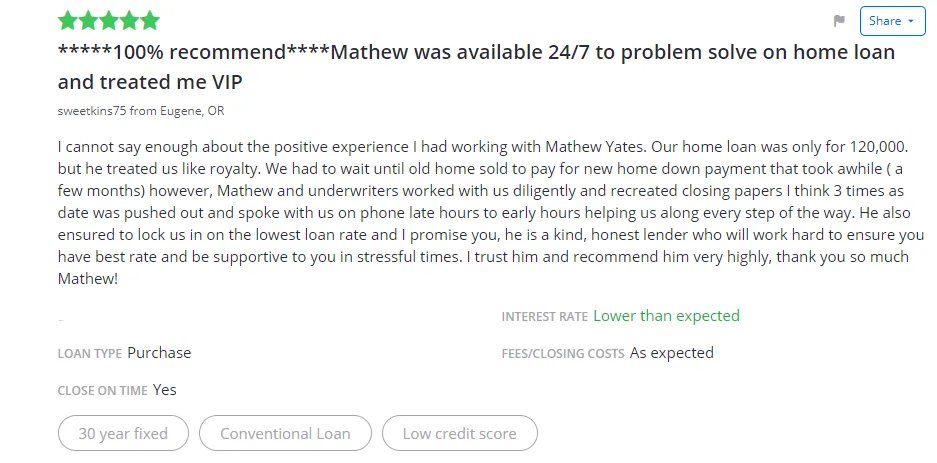

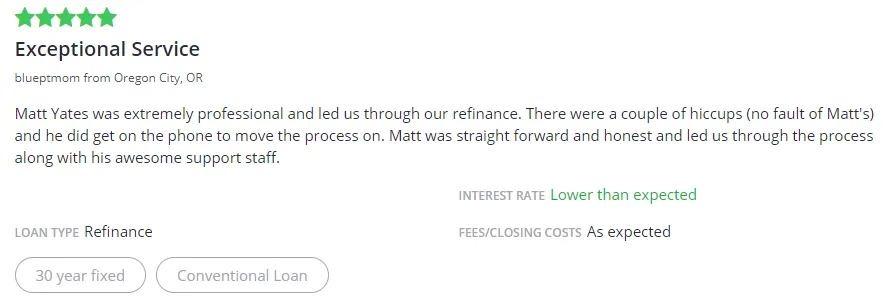

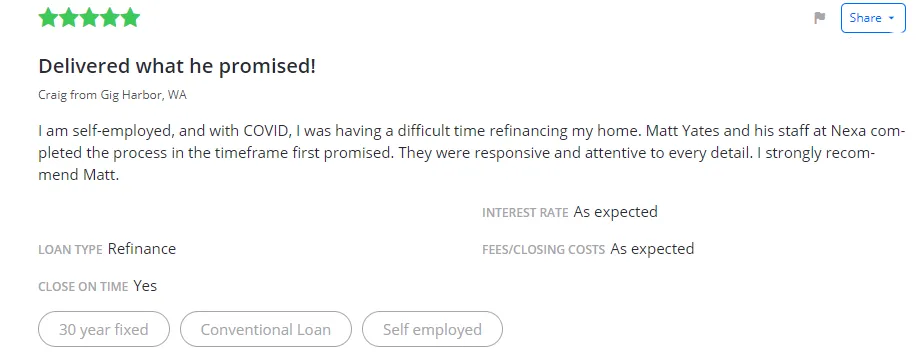

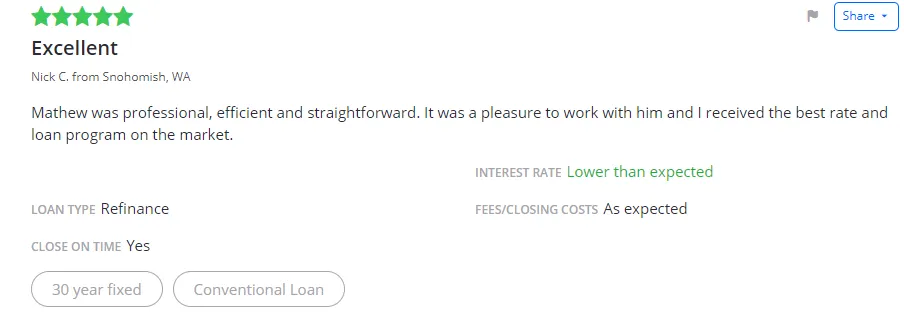

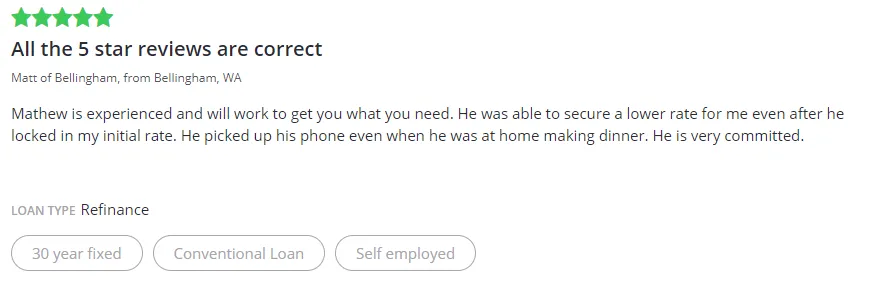

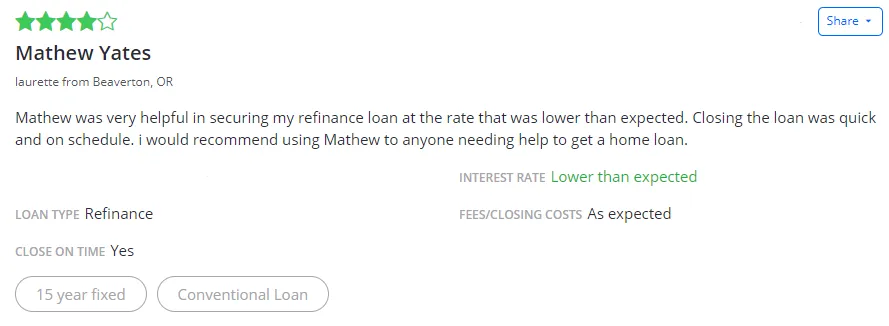

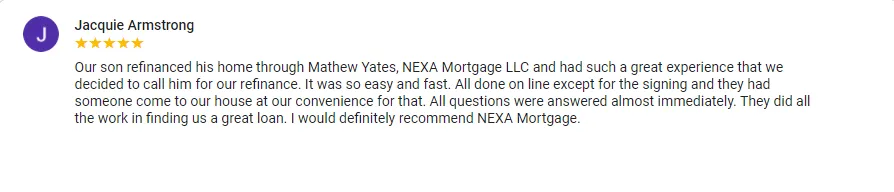

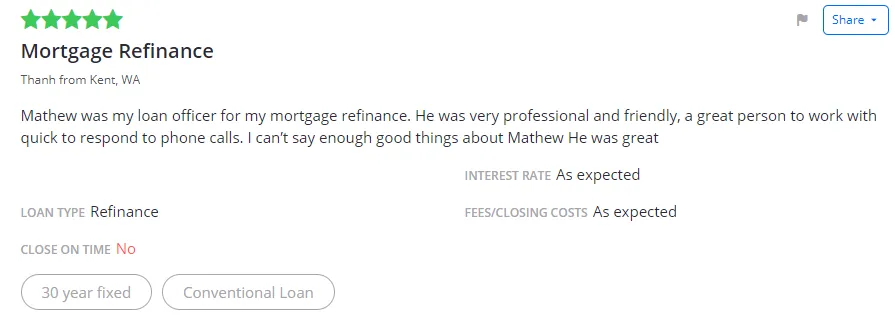

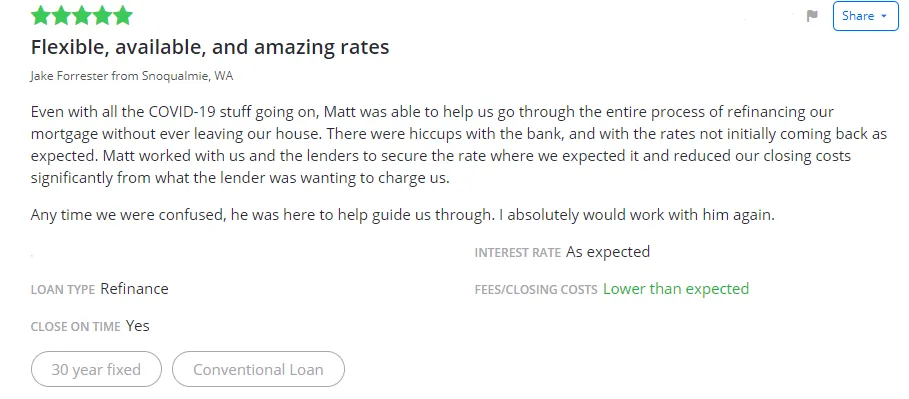

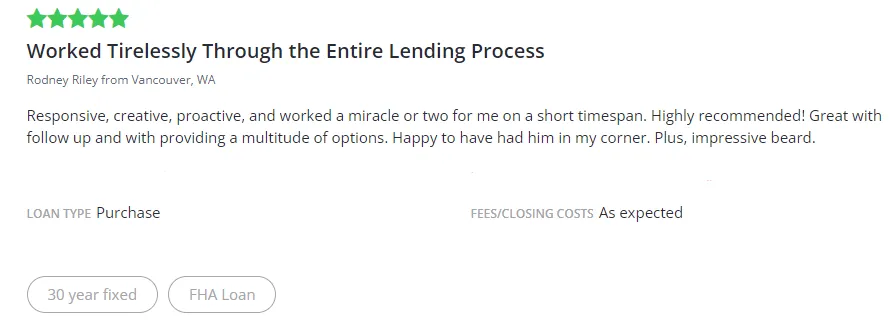

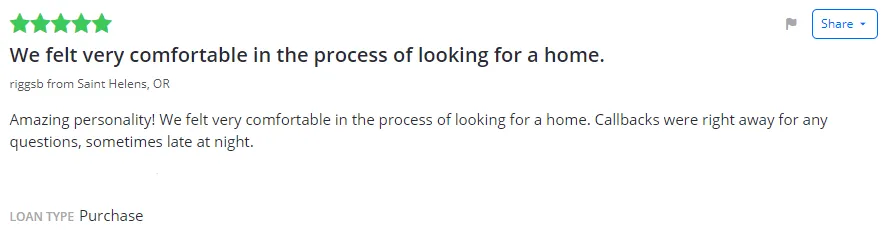

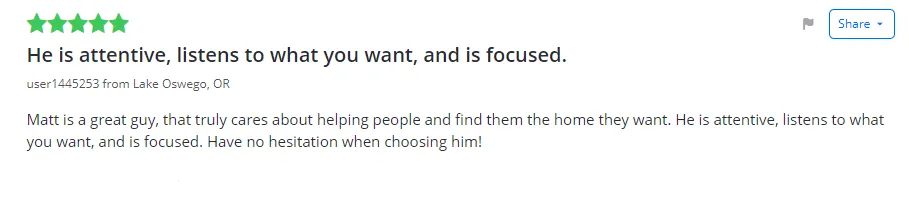

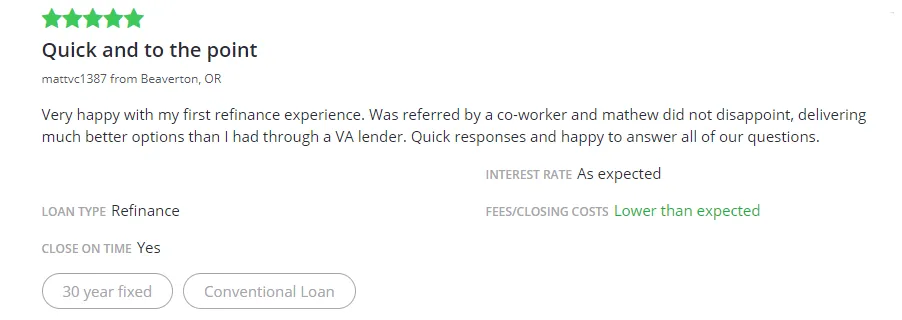

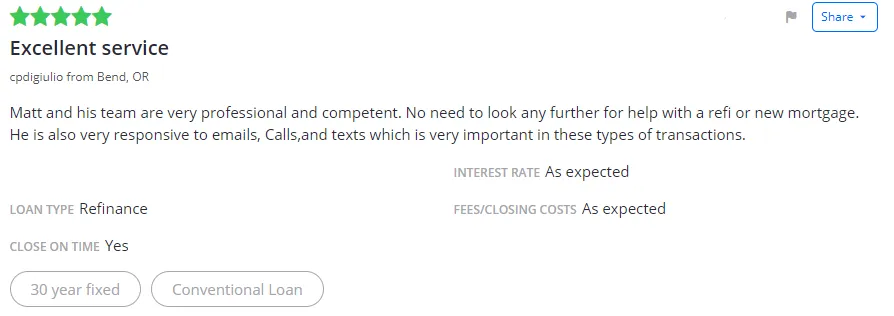

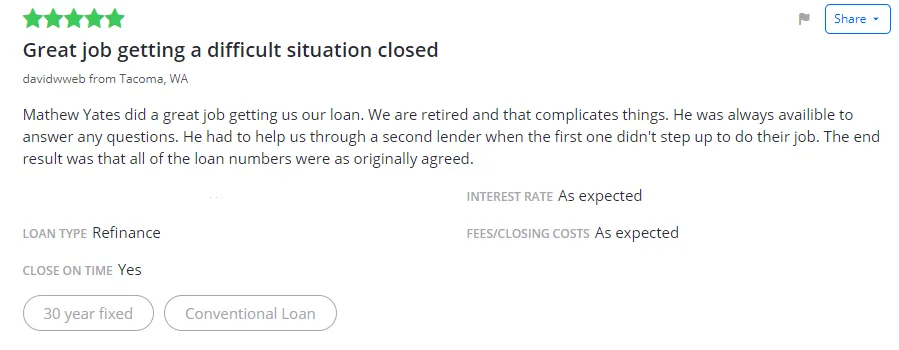

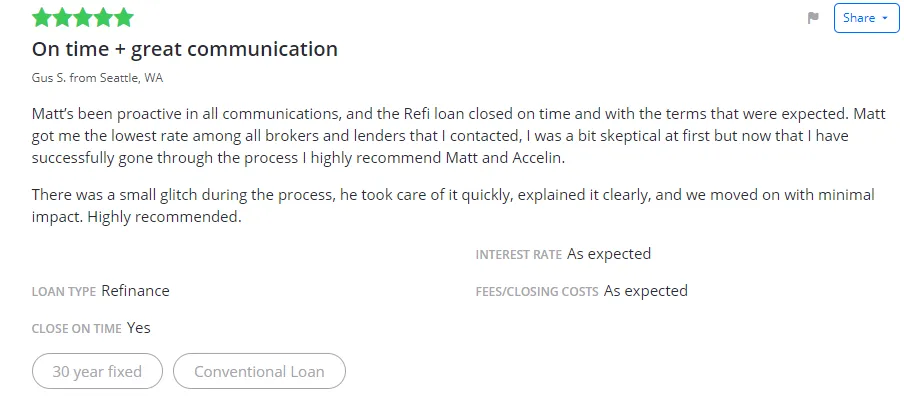

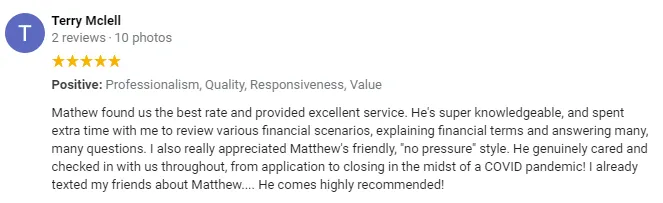

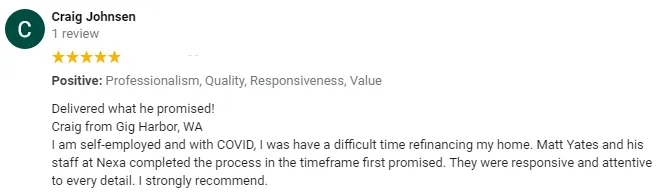

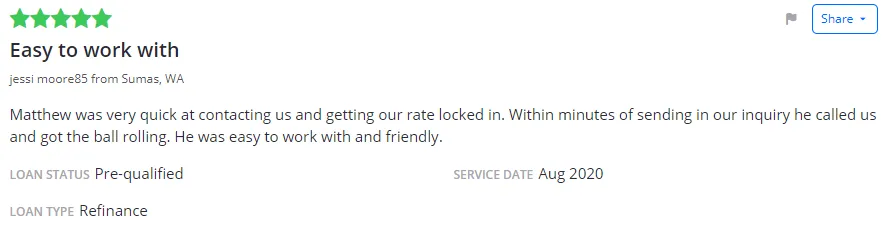

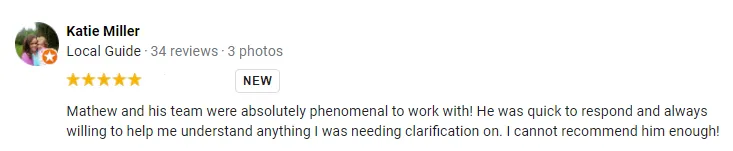

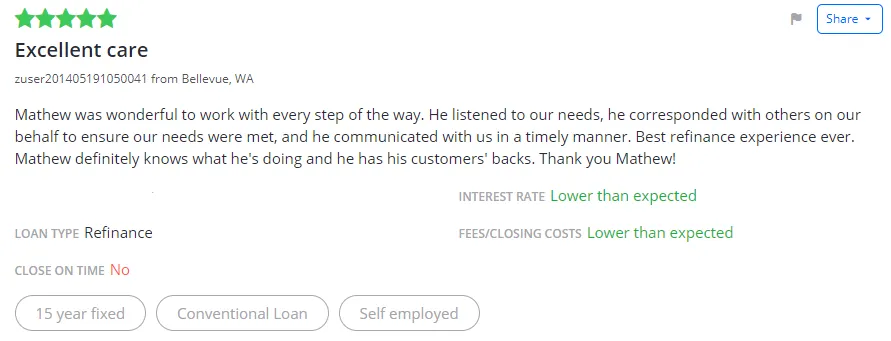

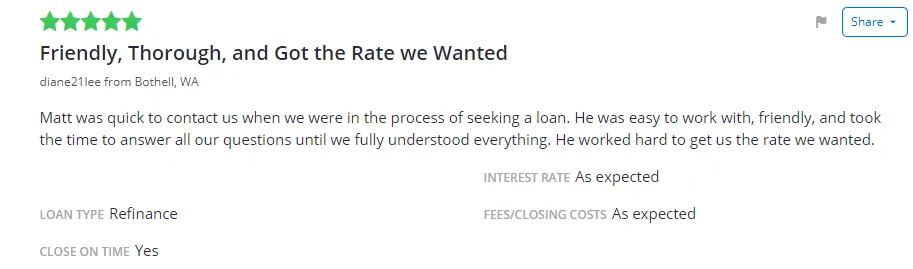

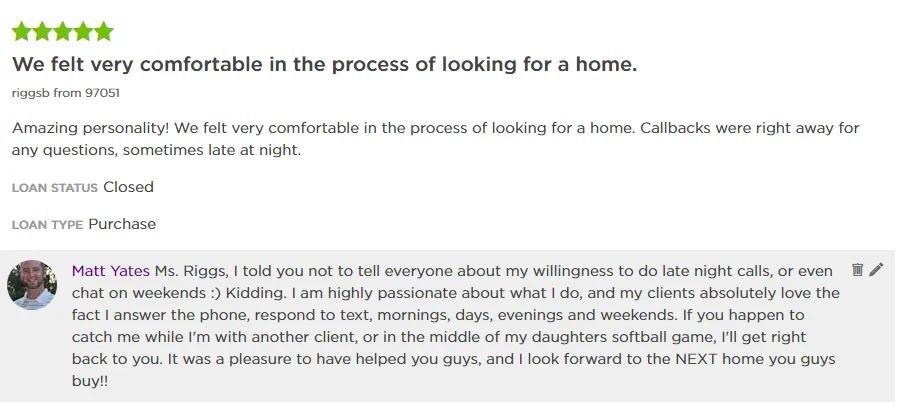

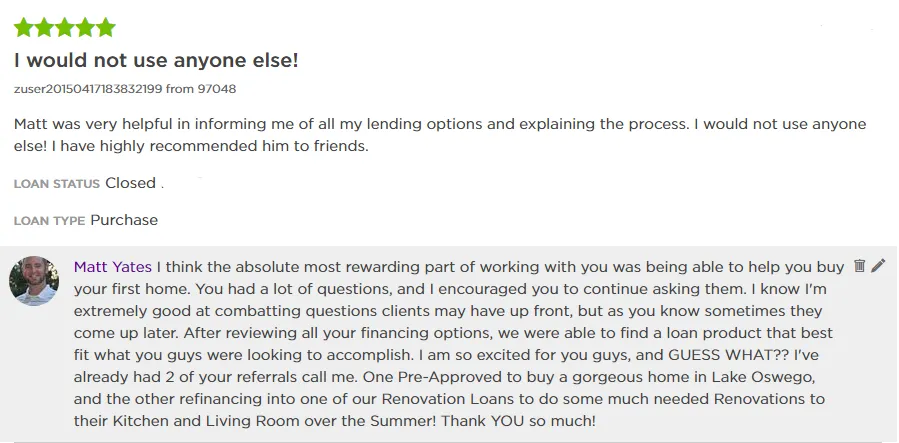

Testimonials

NMLS ID #423065

Contact Me

20225 Water Tower Blvd. Suite 400, Brookfield, WI 53045

NMLS ID #1173903

Novus Home Mortgage, a division of Ixonia Bank is an Equal Housing Lender. We are headquartered at 20225 Water Tower Blvd. Suite 400, Brookfield, WI 53045. Toll free (844) 337-2548. NMLS No. 423065 (www.nmlsconsumeraccess.org). This is not an offer to enter into an agreement or a commitment to lend. All loans are subject to credit approval as well as program requirements and guidelines. Rates and requirements are subject to change without notice. Not all products are available in all states. Other restrictions or limitations may apply. Novus Home Mortgage, a division of Ixonia Bank is not affiliated with any government agency. © Novus Home Mortgage. All Rights Reserved | Program, Rate & APR Examples | Accessibility